5 Key Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do: Network Strategically within the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is essential for uncovering hidden job opportunities and gaining valuable insights.

Leverage LinkedIn:

LinkedIn is your primary tool for networking in the private credit job market.

- Follow key players and industry influencers: Stay updated on industry trends and gain valuable perspectives.

- Share insightful articles and contribute to conversations: Establish yourself as a thought leader and engage with potential employers.

- Customize your LinkedIn profile to highlight private credit experience and skills: Use keywords like credit analysis, portfolio management, direct lending, mezzanine financing, and distressed debt to optimize your profile for recruiter searches.

Attend Industry Events:

Conferences, seminars, and workshops provide invaluable networking opportunities.

- Prepare insightful questions to engage with attendees and speakers: Show genuine interest and demonstrate your knowledge.

- Follow up with meaningful connections after the event: Send personalized emails reinforcing your conversation and expressing your continued interest.

- Consider joining relevant professional organizations: Groups like the Alternative Credit Council (ACC) can provide access to exclusive networking events and resources.

Informational Interviews:

Informational interviews offer a chance to learn from experienced professionals and build relationships.

- Research the individuals beforehand: Understand their background and career path to prepare relevant questions.

- Prepare thoughtful questions and show genuine interest: Demonstrate your enthusiasm for the private credit industry.

- Send a thank-you note following the interview: Express your gratitude and reiterate your interest in the private credit job market.

Don't: Neglect Your Online Presence

Your online presence is often the first impression potential employers have of you. A strong online presence is crucial for success in the private credit job market.

Update your Resume and Cover Letter:

Your resume and cover letter must be tailored to each specific private credit job application.

- Quantify your achievements whenever possible: Use metrics and numbers to demonstrate your impact.

- Use keywords relevant to private credit roles: Incorporate terms like underwriting, due diligence, financial modeling, and risk assessment.

- Proofread meticulously for any errors: Typos and grammatical errors can severely damage your credibility.

Ignore Online Reviews and Company Research:

Thorough research is essential before applying or interviewing for any private credit role.

- Understand the firm's investment strategy and recent deals: Demonstrate your knowledge of their specific area within private credit.

- Prepare questions that demonstrate your understanding of their business: Show you've done your homework and are genuinely interested.

- Check Glassdoor and LinkedIn for insights into company culture and employee experiences: Understand the work environment before committing to an interview.

Do: Showcase Specialized Skills and Experience

The private credit job market is highly competitive. Highlighting your unique skills and experience is crucial.

Highlight Relevant Expertise:

Emphasize skills and experience directly applicable to private credit roles.

- Quantify your successes with specific examples and numbers: Demonstrate the value you bring to a potential employer.

- Demonstrate your understanding of different credit strategies: Showcase your knowledge of direct lending, mezzanine financing, and distressed debt.

- Show proficiency in relevant software: Mention your experience with Bloomberg Terminal, Argus, or other relevant financial software.

Demonstrate Strong Analytical Abilities:

Strong analytical and problem-solving skills are paramount in private credit.

- Use case studies to illustrate your analytical approach: Show how you've tackled complex problems in the past.

- Highlight your experience with complex financial modeling: Demonstrate your proficiency in building and interpreting financial models.

- Emphasize your ability to identify and assess risks: Show your understanding of the risks involved in private credit investments.

Don't: Underestimate the Importance of Soft Skills

While technical skills are essential, soft skills are equally crucial for success in the private credit job market.

Neglect Communication Skills:

Effective communication is vital for interacting with clients, colleagues, and senior management.

- Practice articulating your thoughts clearly and concisely: Ensure your message is understood easily.

- Develop strong presentation skills: Be able to confidently present your ideas and analysis to others.

- Demonstrate active listening abilities: Pay close attention to what others are saying and respond appropriately.

Lack Teamwork and Collaboration:

Private credit often involves working in teams. Highlight your collaborative spirit.

- Provide specific examples of successful teamwork experiences: Demonstrate your ability to work effectively within a team.

- Demonstrate your ability to work effectively under pressure: Show you can handle the demands of a fast-paced environment.

- Show your willingness to support your team members: Highlight your collaborative nature and team-oriented approach.

Do: Prepare Thoroughly for Interviews

Thorough preparation is key to a successful private credit job interview.

Research the Firm and Interviewers:

Understanding the firm and the interviewers is critical for a successful interview.

- Prepare thoughtful questions to ask the interviewers: Show your interest and engagement.

- Research industry news related to the firm and its competitors: Demonstrate your up-to-date knowledge of the market.

- Practice your answers to common interview questions: Prepare for questions about your experience, skills, and career goals.

Practice Behavioral Questions:

Behavioral questions assess your past behavior to predict future performance.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers: Provide a clear and concise narrative of your experiences.

- Focus on demonstrating your problem-solving skills, teamwork abilities, and leadership qualities: Showcase your key strengths.

- Show your passion for private credit and your desire to learn: Express your genuine interest in the field.

Conclusion

Successfully navigating the private credit job market demands a strategic approach that blends technical skills with effective networking and communication. By following these do's and don'ts, you significantly increase your chances of securing a rewarding career in this dynamic field. Remember to network strategically, showcase your expertise, refine your soft skills, and prepare thoroughly for interviews. Start applying these strategies today and take control of your future in the private credit job market.

Featured Posts

-

Breda In Het Duister Impact Van De Stroomuitval Op De Stad

May 02, 2025

Breda In Het Duister Impact Van De Stroomuitval Op De Stad

May 02, 2025 -

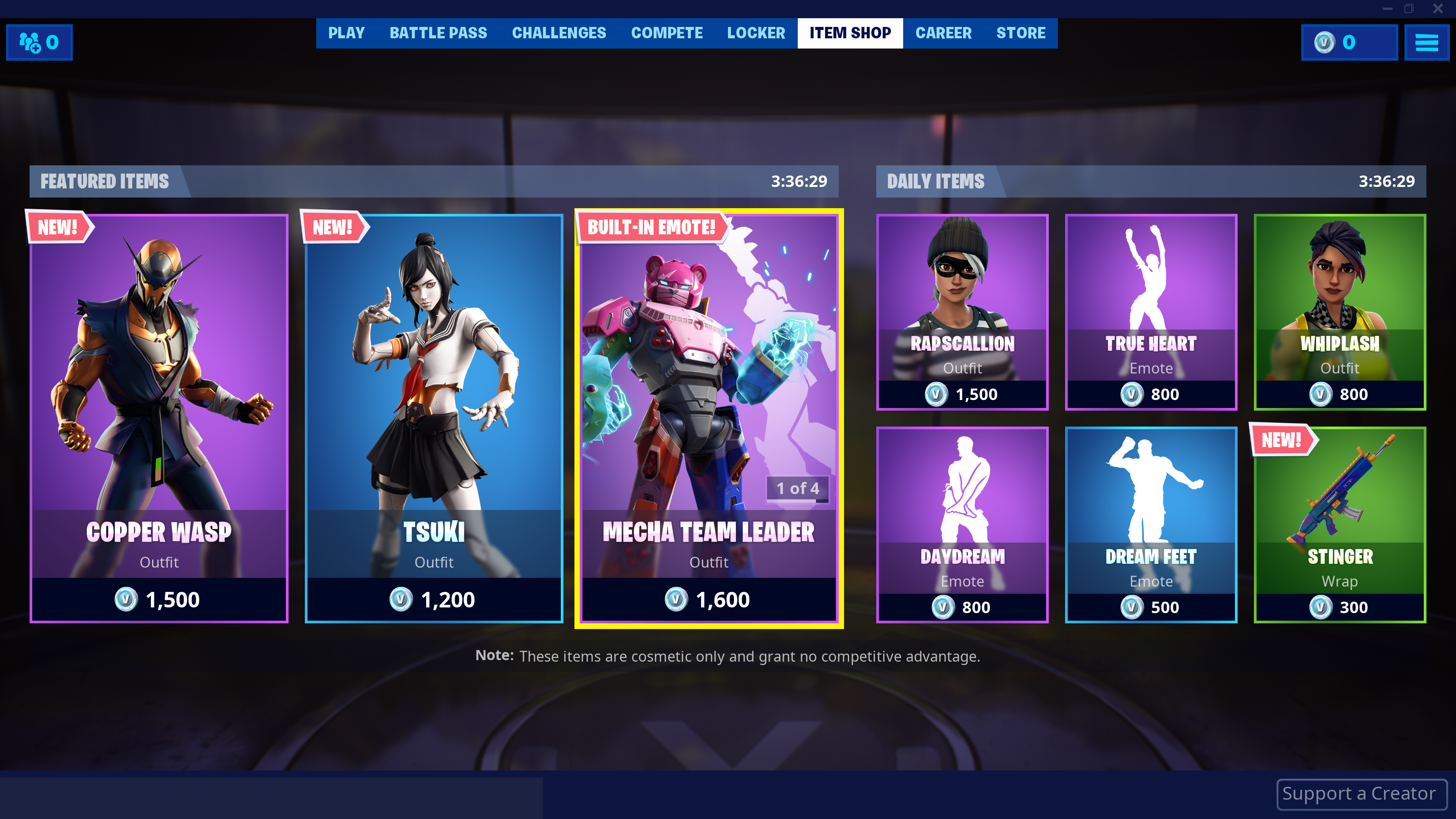

Fortnite Item Shop Update A Wave Of Negative Feedback

May 02, 2025

Fortnite Item Shop Update A Wave Of Negative Feedback

May 02, 2025 -

End Of School Desegregation Order A Turning Point In Education

May 02, 2025

End Of School Desegregation Order A Turning Point In Education

May 02, 2025 -

Understanding Mental Health A Conversation With Dr Shradha Malik

May 02, 2025

Understanding Mental Health A Conversation With Dr Shradha Malik

May 02, 2025 -

Christina Aguileras Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025

Christina Aguileras Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025

Latest Posts

-

Kocaeli Nde 1 Mayis Ta Yasananlar Arbede Ve Tepkiler

May 03, 2025

Kocaeli Nde 1 Mayis Ta Yasananlar Arbede Ve Tepkiler

May 03, 2025 -

Kocaeli 1 Mayis Kutlamalari Siddet Ve Gerilim

May 03, 2025

Kocaeli 1 Mayis Kutlamalari Siddet Ve Gerilim

May 03, 2025 -

1 Mayis Kocaeli Kutlamalarin Goelgesindeki Arbede

May 03, 2025

1 Mayis Kocaeli Kutlamalarin Goelgesindeki Arbede

May 03, 2025 -

Kocaeli Nde 1 Mayis Arbede Ve Sonrasi

May 03, 2025

Kocaeli Nde 1 Mayis Arbede Ve Sonrasi

May 03, 2025 -

Battle Riot Vii Bobby Fishs Participation Announced By Mlw

May 03, 2025

Battle Riot Vii Bobby Fishs Participation Announced By Mlw

May 03, 2025