5 Key Actions To Secure A Role In The Private Credit Boom

Table of Contents

Network Strategically within the Private Credit Industry

Building a strong network is paramount to securing a role in private credit. The industry thrives on relationships, and making connections with the right people can significantly increase your chances of landing your dream job.

Attend Industry Events and Conferences

Attending private credit conferences and industry events provides invaluable networking opportunities. These events bring together key players, offering a chance to learn about new trends, exchange ideas, and build relationships.

- Relevant Conferences: Consider attending events like SuperReturn, PEI's conferences, and industry-specific gatherings focused on private debt and alternative lending.

- Effective Networking: Prepare talking points highlighting your skills and experience. Actively engage in conversations, exchange business cards, and follow up with connections after the event. Remember to research attendees beforehand to identify potential mentors or future employers. Don't forget to leverage the event's networking apps to maximize connections.

Leverage LinkedIn and Professional Organizations

Your LinkedIn profile is your digital resume and a crucial networking tool. Optimize it to showcase your private credit expertise and make it easily searchable by recruiters. Active participation in relevant professional groups can further expand your network and keep you updated on industry trends.

- LinkedIn Profile Optimization: Use relevant keywords like "private credit," "credit analysis," "due diligence," and "financial modeling." Highlight quantifiable achievements and tailor your experience section to emphasize relevant skills. Add a professional headshot and ensure your profile is complete.

- Professional Networking: Join groups like the CFA Institute, the Association for Financial Professionals (AFP), and industry-specific associations focused on private debt and alternative lending. Participate in discussions, share insightful articles, and engage with other members to build your presence. Private credit LinkedIn groups are a goldmine of industry insight and networking opportunities.

Develop In-Demand Skills for Private Credit Roles

Private credit roles require a specific skillset. Investing time in developing these in-demand skills will significantly enhance your competitiveness.

Master Financial Modeling and Analysis

Proficiency in financial modeling is essential for private credit professionals. Your ability to analyze financial statements, build LBO models, and perform discounted cash flow (DCF) analysis will be heavily scrutinized.

- Specific Modeling Skills: Master LBO modeling, DCF analysis, sensitivity analysis, and scenario planning. Understand key financial metrics like EBITDA, leverage ratios, and interest coverage ratios.

- Skill Development: Explore online courses offered by platforms like Coursera, edX, and Udemy. Practice building models using real-world case studies and consider seeking mentorship from experienced professionals. Financial modeling skills are highly sought-after in private credit analysis.

Understand Credit Risk Assessment and Due Diligence

A deep understanding of credit risk assessment and the due diligence process is crucial. You'll need to be comfortable analyzing borrowers' financial health, identifying potential risks, and structuring deals to mitigate those risks.

- Areas of Expertise: Develop expertise in covenant compliance, credit scoring models, and collateral valuation. Understand different types of credit facilities and their associated risks.

- Further Education: Consider pursuing relevant certifications or further education. The more expertise you have in credit risk assessment and due diligence, the better your chances of success in private credit underwriting.

Tailor Your Resume and Cover Letter for Private Credit Positions

Your resume and cover letter are your first impression. Tailoring them to specific private credit positions significantly improves your chances of getting an interview.

Highlight Relevant Experience and Skills

Showcase your experience and skills using action verbs and quantifiable results. Use keywords from the job description to demonstrate your understanding of the role's requirements.

- Resume Optimization: Use a clean and easy-to-read format. Quantify your achievements with numbers and data to demonstrate your impact. Highlight any experience in areas like financial modeling, credit analysis, or due diligence. Tailor your resume to each specific private credit role, highlighting the skills and experiences most relevant to the job description.

- Cover Letter Writing: Craft a compelling narrative that highlights your skills and experience. Explain your interest in the specific firm and role. Use keywords to show that you understand the position and its requirements.

Quantify Your Achievements

Quantifiable results significantly strengthen your application. Show the impact of your past work using concrete numbers and data.

- Examples of Quantifiable Achievements: "Increased profitability by 15%," "Reduced risk by 10%," "Improved efficiency by 20%." Quantify your results whenever possible in your private credit achievements.

Prepare for the Private Credit Interview Process

Thorough preparation is critical for success in private credit interviews. Practice answering both behavioral and technical questions and research potential employers.

Practice Behavioral and Technical Interview Questions

Expect a mix of behavioral and technical questions designed to assess your skills, experience, and personality. Prepare answers that showcase your strengths and highlight your relevant experiences.

- Common Interview Questions: Practice answering questions about your strengths and weaknesses, your experience in private credit, and your understanding of financial modeling and credit analysis. Prepare answers that specifically highlight your experience in private credit.

- Effective Answering: Use the STAR method (Situation, Task, Action, Result) to structure your answers. Practice your answers out loud to build confidence. Private credit interview preparation is key to success.

Research Potential Employers Thoroughly

Research the firm's investment strategy, recent transactions, and company culture. Demonstrating your knowledge shows genuine interest and helps you tailor your responses to the firm's specific needs.

- Employer Research: Visit the firm's website, read news articles and press releases, and research the investment team's backgrounds. Understand their investment strategy and recent transactions. Researching private credit firms thoroughly will demonstrate your commitment.

Consider Further Education or Certifications

Further education or relevant certifications can significantly enhance your credentials and improve your job prospects.

Relevant Certifications and Degrees

Consider pursuing the Chartered Financial Analyst (CFA) charter, the Chartered Alternative Investment Analyst (CAIA) charter, or an MBA in finance. These credentials demonstrate a high level of expertise and commitment to the field.

- Benefits: Certifications and degrees provide structured learning, enhance your credibility, and signal commitment to the industry. Private credit certifications enhance your resume and demonstrate a commitment to the profession.

- Specific Certifications and Degrees: CFA, CAIA, MBA (with a focus on finance).

Online Courses and Workshops

Numerous online resources provide targeted training in private credit. These courses offer flexibility and focused learning on specific skills.

- Reputable Online Courses and Workshops: Explore platforms like Coursera, edX, and Udemy for private credit training and skill development.

Conclusion: Securing Your Place in the Private Credit Boom

Securing a role in the private credit boom requires strategic planning and proactive action. By focusing on networking, skill development, resume optimization, interview preparation, and pursuing further education, you can significantly improve your chances of success. Remember, the private credit industry offers exciting opportunities, and by implementing these five key actions today, you can secure your place in this dynamic and rewarding field. Start implementing these five key actions today to secure your place in the exciting world of private credit!

Featured Posts

-

Will Chinese Cars Dominate The Global Market

Apr 26, 2025

Will Chinese Cars Dominate The Global Market

Apr 26, 2025 -

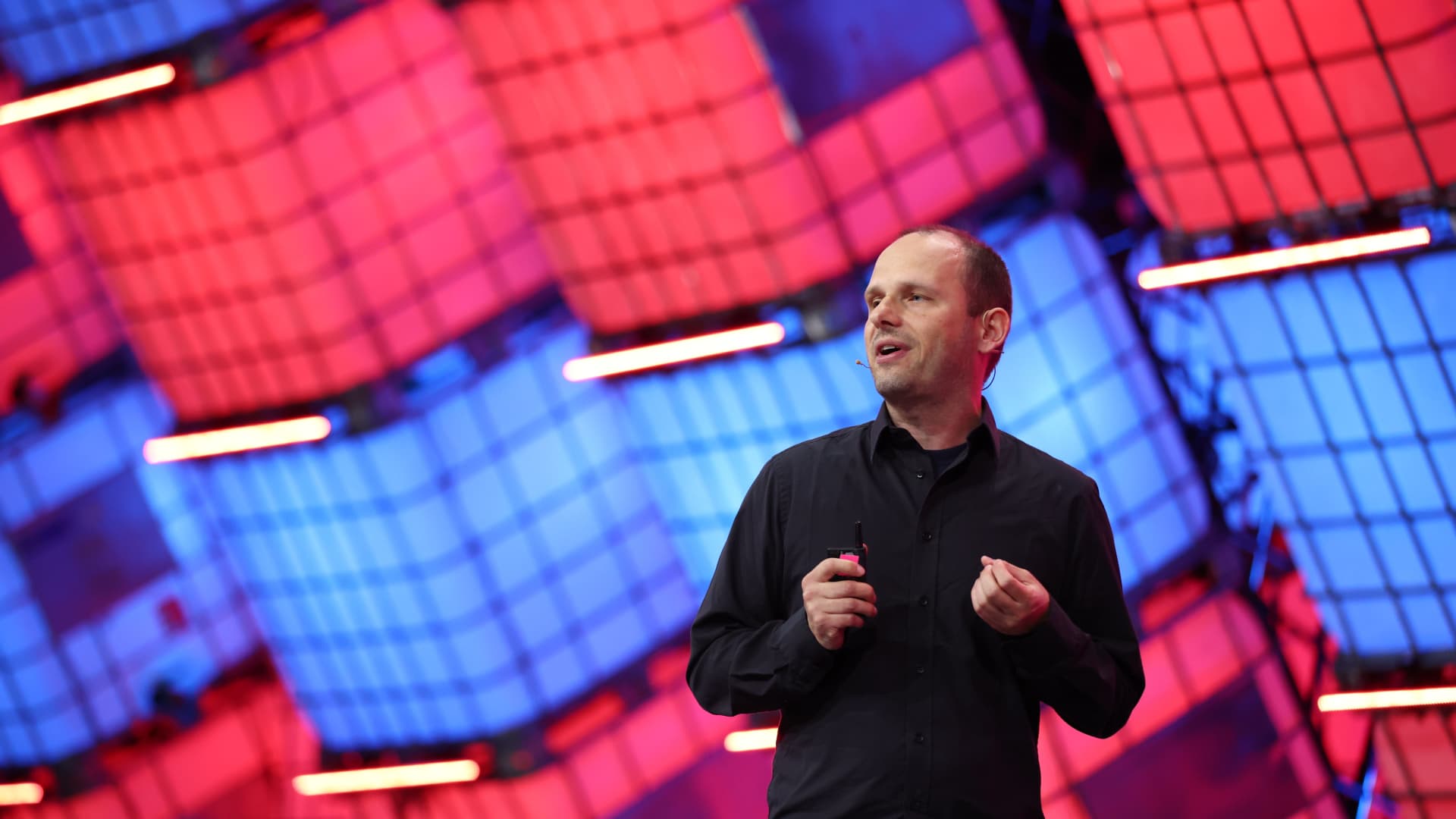

Microsofts Design Chief On The Future Of Human Centered Ai

Apr 26, 2025

Microsofts Design Chief On The Future Of Human Centered Ai

Apr 26, 2025 -

Pentagon Chaos Exclusive Report On Hegseth Leaks And Infighting

Apr 26, 2025

Pentagon Chaos Exclusive Report On Hegseth Leaks And Infighting

Apr 26, 2025 -

January 6th Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 26, 2025

January 6th Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 26, 2025 -

Chronology Of The Karen Read Murder Cases

Apr 26, 2025

Chronology Of The Karen Read Murder Cases

Apr 26, 2025

Latest Posts

-

Three Set Thriller Rybakina Triumphs Over Jabeur In Abu Dhabi

Apr 27, 2025

Three Set Thriller Rybakina Triumphs Over Jabeur In Abu Dhabi

Apr 27, 2025 -

Jabeur Falls To Rybakina In Hard Fought Mubadala Abu Dhabi Open Contest

Apr 27, 2025

Jabeur Falls To Rybakina In Hard Fought Mubadala Abu Dhabi Open Contest

Apr 27, 2025 -

Mubadala Abu Dhabi Open Rybakina Wins Close Battle Against Jabeur

Apr 27, 2025

Mubadala Abu Dhabi Open Rybakina Wins Close Battle Against Jabeur

Apr 27, 2025 -

Rybakina Edges Jabeur In Three Set Mubadala Abu Dhabi Open Match

Apr 27, 2025

Rybakina Edges Jabeur In Three Set Mubadala Abu Dhabi Open Match

Apr 27, 2025 -

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025

Rybakina Defeats Jabeur In Thrilling Mubadala Abu Dhabi Open Final

Apr 27, 2025