5 Do's And Don'ts For Landing A Private Credit Job

Table of Contents

Do's for Landing a Private Credit Job

Do: Develop Specialized Skills and Knowledge

The private credit industry demands a specialized skill set. Mastering core competencies is crucial for success. This goes beyond general finance knowledge; you need a deep understanding of the intricacies of private debt. Crucial skills include:

- Financial modeling: Proficiency in building sophisticated financial models to assess creditworthiness and project cash flows is paramount.

- Credit analysis: You must be adept at analyzing financial statements, evaluating credit risk, and determining appropriate credit terms.

- Underwriting: Understanding the underwriting process, including due diligence and risk assessment, is essential for evaluating potential investments.

- Valuation: The ability to value various assets and liabilities accurately is crucial in private credit transactions. This includes understanding different valuation methodologies.

- Due diligence: Thorough due diligence is critical to identifying and mitigating potential risks associated with private debt investments.

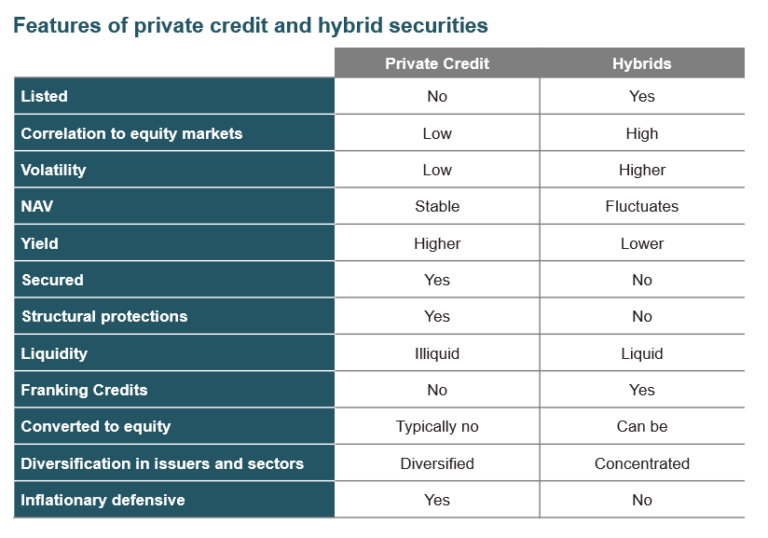

Understanding different credit structures is also essential. You should be familiar with senior secured debt, mezzanine financing, and subordinated debt, among others, and their respective risk-return profiles. A comprehensive understanding of the legal and regulatory frameworks governing private credit transactions is also a must.

To further enhance your credibility, consider pursuing relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

- Strong Excel skills

- Financial modeling proficiency

- Understanding of legal documentation

- Knowledge of industry trends

Do: Network Strategically

Networking is incredibly important in the private credit world. Building relationships with professionals in the field can open doors to unadvertised opportunities.

- Attend industry conferences: These events provide excellent networking opportunities and expose you to the latest trends.

- Join relevant LinkedIn groups: Engage in discussions and connect with individuals working in private credit.

- Informational interviews: Reach out to professionals for informational interviews to learn about their experiences and gain insights into the industry.

- Network with alumni: Leverage your alumni network to connect with professionals who might be working in private credit.

Do: Tailor Your Resume and Cover Letter

Submitting generic applications is a surefire way to fail. Each application should be meticulously tailored to the specific job description and the firm's culture.

- Quantify achievements: Showcase your accomplishments with quantifiable results whenever possible.

- Use keywords from job descriptions: Incorporate keywords from the job description to optimize your application for applicant tracking systems (ATS).

- Tailor to each application: Your resume and cover letter should reflect the unique requirements of each private credit job.

- Highlight relevant skills: Emphasize the skills and experience most relevant to the specific role.

Don'ts for Landing a Private Credit Job

Don't: Neglect the Fundamentals

A strong foundation in finance and accounting is non-negotiable. Don't underestimate the importance of core concepts.

- Weak understanding of financial statements

- Lack of accounting knowledge

- Poor grasp of economic principles

Don't: Underestimate the Importance of Communication Skills

Effective communication is crucial in private credit. You'll be interacting with clients, colleagues, and senior management.

- Poor written communication

- Weak presentation skills

- Difficulty building rapport

Don't: Submit Generic Applications

Generic applications demonstrate a lack of genuine interest and effort.

- Generic cover letters

- Lack of company research

- No demonstration of genuine interest

Conclusion

Landing a private credit job is competitive, but with a strategic approach, you can significantly improve your chances. By following these do's and don'ts – developing specialized skills, networking strategically, and tailoring your applications – you'll stand out from the competition. Remember to hone your fundamental knowledge, cultivate excellent communication skills, and demonstrate genuine interest in each firm and role. By following these guidelines, you'll significantly improve your chances of landing your dream private credit job. Start honing your skills and networking today! Begin your search for private credit analyst jobs, private debt jobs, or alternative lending careers with renewed confidence.

Featured Posts

-

Diamondbacks Dramatic Ninth Inning Comeback Wins Game Against Brewers

Apr 23, 2025

Diamondbacks Dramatic Ninth Inning Comeback Wins Game Against Brewers

Apr 23, 2025 -

Yankees Opening Day Success Dissecting Their Winning Performance Against The Brewers

Apr 23, 2025

Yankees Opening Day Success Dissecting Their Winning Performance Against The Brewers

Apr 23, 2025 -

Solutions 30 Perspectives Haussieres Sur Le Titre En Bourse

Apr 23, 2025

Solutions 30 Perspectives Haussieres Sur Le Titre En Bourse

Apr 23, 2025 -

Valeur Ajoutee Infotel Pourquoi Les Clients Apprecient

Apr 23, 2025

Valeur Ajoutee Infotel Pourquoi Les Clients Apprecient

Apr 23, 2025 -

Three Straight 1 0 Losses For The Reds

Apr 23, 2025

Three Straight 1 0 Losses For The Reds

Apr 23, 2025