400% XRP Price Increase: A Buyer's Guide And Risk Assessment

Table of Contents

Factors Contributing to the XRP Price Increase

Several factors have converged to propel the XRP price to new heights. Understanding these is crucial for assessing the sustainability of this increase.

Positive Ripple Developments

Recent legal wins for Ripple Labs have significantly impacted XRP's price. The partial victory in the SEC lawsuit, while not a complete exoneration, injected a wave of optimism into the market. This positive sentiment is further amplified by:

- Ongoing legal progress: Positive developments in the ongoing legal battle continue to boost investor confidence in the long-term prospects of XRP.

- Strategic partnerships: Ripple's partnerships with various financial institutions for cross-border payment solutions have broadened XRP's adoption and utility. These collaborations demonstrate a growing acceptance of XRP within the financial industry.

- Technological advancements: Continuous improvements to Ripple's technology, including enhancements to its speed and efficiency, are driving further adoption and strengthening its position in the market. This reinforces the belief in XRP's long-term potential as a payment solution.

These factors collectively contribute to a more positive outlook for XRP, influencing investor sentiment and fueling the price increase.

Increased Market Demand & Adoption

The recent XRP price increase is not solely driven by legal wins; increased market demand and adoption play a crucial role. We've observed:

- Soaring trading volume: A dramatic increase in XRP trading volume across major cryptocurrency exchanges indicates heightened investor interest and participation.

- Institutional investment: Growing institutional investment in XRP signifies a shift towards broader acceptance and legitimacy within the financial world.

- Expanding use cases: Beyond cross-border payments, XRP is finding applications in other areas, leading to greater adoption and potential price appreciation. This diversified use increases demand and strengthens XRP's position in the market.

Charts illustrating the surge in trading volume and institutional investment would further solidify these observations.

Overall Market Sentiment

The broader cryptocurrency market sentiment also contributes to the XRP price increase. Factors include:

- Positive Bitcoin price action: A rising Bitcoin price often triggers a positive sentiment across the altcoin market, including XRP.

- Altcoin season: Periods of increased interest in altcoins (cryptocurrencies other than Bitcoin) can significantly impact XRP's price.

- FOMO (Fear Of Missing Out): As the price increases, FOMO can drive further speculation and buying pressure, contributing to the upward trend.

- Macroeconomic factors: Global economic conditions, including inflation and interest rates, can indirectly influence cryptocurrency prices and investor sentiment.

A Buyer's Guide to XRP

Considering investing in XRP after its significant price increase requires careful planning and a strategic approach.

Understanding XRP Investment Strategies

Before investing, understand the various approaches to acquiring and managing XRP:

- Exchanges: Purchase XRP through reputable cryptocurrency exchanges. Choose exchanges known for their security and liquidity.

- Wallets: Store your XRP securely in a compatible cryptocurrency wallet. Consider both hardware and software wallets for optimal security.

- Staking: Some platforms offer XRP staking opportunities, potentially generating passive income. Research platforms thoroughly before participating.

- Diversification: Never invest your entire portfolio in a single asset, especially in a volatile market like cryptocurrencies. Diversification is crucial for mitigating risk.

- Risk management: Define your risk tolerance and investment goals. Only invest an amount you can afford to lose.

Choosing a Reliable Exchange

Selecting a secure and reliable cryptocurrency exchange is paramount. Consider the following factors:

- Security measures: Choose an exchange with robust security protocols to protect your funds from hacking and theft.

- Fees: Compare trading fees and withdrawal fees to minimize costs.

- User experience: Opt for an exchange with a user-friendly interface and robust customer support.

- Regulation: Check the regulatory compliance of the exchange in your jurisdiction.

Remember to thoroughly research and compare different exchanges before making a decision.

Risk Assessment of Investing in XRP

Despite the recent price increase, several risks are associated with investing in XRP.

Volatility and Price Fluctuations

Cryptocurrencies, including XRP, are notoriously volatile. Be prepared for:

- Significant price drops: The price of XRP can fluctuate dramatically in short periods, leading to substantial losses.

- Market corrections: Expect periodic market corrections where the price falls significantly before potentially recovering.

- Historical volatility: Analyze historical XRP price charts to understand the extent of its past volatility.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain, presenting ongoing risks:

- Ongoing legal challenges: The regulatory scrutiny surrounding XRP and other cryptocurrencies remains a significant risk factor.

- Government intervention: Governments worldwide are still developing regulatory frameworks for cryptocurrencies. Changes in regulations can significantly impact XRP's price.

Security Risks

Security risks associated with holding and trading XRP include:

- Exchange hacks: Cryptocurrency exchanges are potential targets for hackers.

- Wallet vulnerabilities: Improperly secured wallets are susceptible to theft.

- Phishing scams: Be wary of phishing attempts aiming to steal your login credentials or private keys.

Conclusion:

The substantial XRP price increase presents both exciting opportunities and significant risks. Positive developments surrounding Ripple and increased market demand have contributed to the price surge. However, investors must remain acutely aware of the inherent volatility, regulatory uncertainty, and security risks involved. A thorough understanding of XRP investment strategies, the selection of a reliable exchange, and a careful assessment of your risk tolerance are crucial before investing. Remember to conduct your own in-depth research and consider seeking professional financial advice before making any investment decisions related to the XRP price increase or any cryptocurrency. Don't miss out on the potential, but approach the current XRP price increase with caution and a well-defined strategy.

Featured Posts

-

Grote Stroomstoring In Breda Updates En Informatie

May 02, 2025

Grote Stroomstoring In Breda Updates En Informatie

May 02, 2025 -

When Is Newsround On Bbc Two Hd A Complete Tv Guide

May 02, 2025

When Is Newsround On Bbc Two Hd A Complete Tv Guide

May 02, 2025 -

Sabrina Carpenter In Fortnite Release Date And Time

May 02, 2025

Sabrina Carpenter In Fortnite Release Date And Time

May 02, 2025 -

Aventure De 8 000 Km Le Recit De Trois Jeunes Ornais

May 02, 2025

Aventure De 8 000 Km Le Recit De Trois Jeunes Ornais

May 02, 2025 -

Aj Ywm Ykjhty Kshmyr Pakstan Bhr Myn Mzahre Awr Tqrybat

May 02, 2025

Aj Ywm Ykjhty Kshmyr Pakstan Bhr Myn Mzahre Awr Tqrybat

May 02, 2025

Latest Posts

-

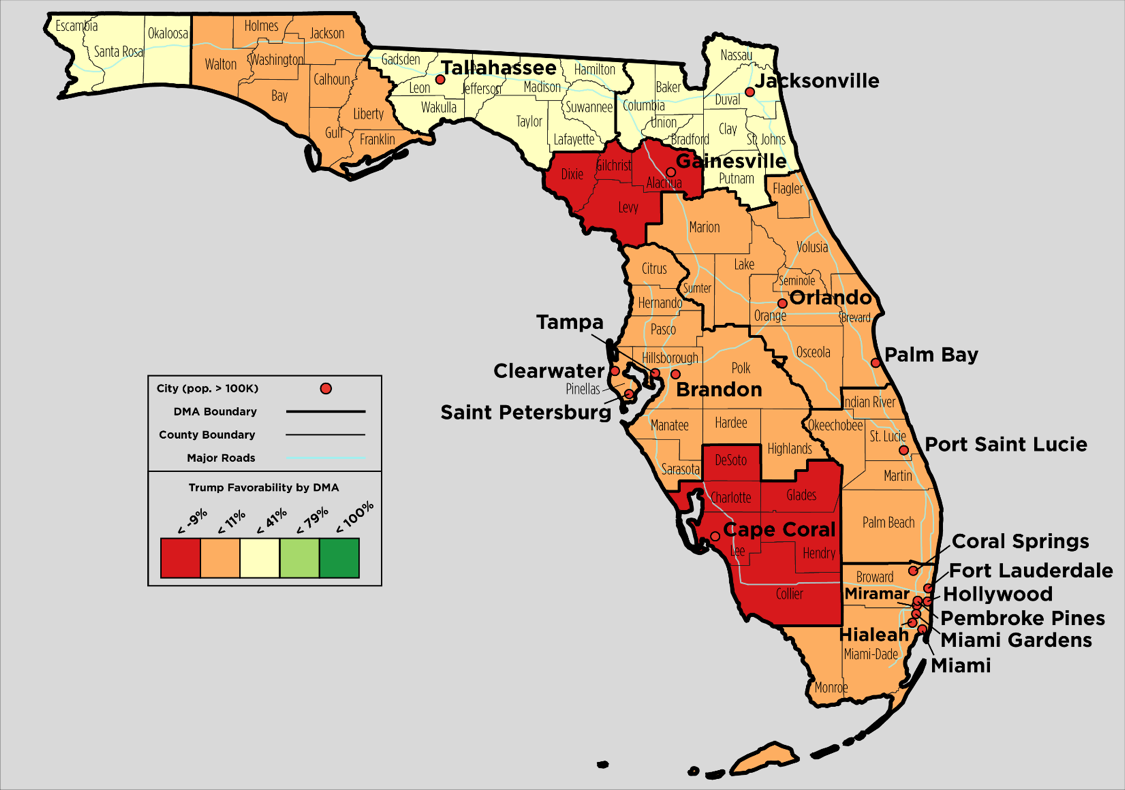

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025 -

Bbcs 1 Billion Revenue Loss Unprecedented Impact On Broadcasting

May 02, 2025

Bbcs 1 Billion Revenue Loss Unprecedented Impact On Broadcasting

May 02, 2025 -

Significant Bbc Funding Cut Unprecedented Challenges Loom

May 02, 2025

Significant Bbc Funding Cut Unprecedented Challenges Loom

May 02, 2025 -

Bbc Issues Warning Unprecedented Difficulties After 1bn Revenue Loss

May 02, 2025

Bbc Issues Warning Unprecedented Difficulties After 1bn Revenue Loss

May 02, 2025 -

Unprecedented Problems For Bbc Following 1bn Income Reduction

May 02, 2025

Unprecedented Problems For Bbc Following 1bn Income Reduction

May 02, 2025