400% XRP Gain In 3 Months: Is It Too Late To Buy? Market Outlook.

Table of Contents

Analyzing XRP's Recent 400% Surge

Factors Contributing to the Price Increase

Several factors have contributed to XRP's remarkable price appreciation:

-

Positive Ripple Legal Developments: The ongoing legal battle between Ripple Labs and the SEC has significantly impacted XRP's price. Positive developments in the case, such as favorable court rulings or settlements, often trigger bullish sentiment and price increases. Recent indications of a potential settlement or a positive ruling have significantly boosted investor confidence.

-

Increased Institutional Adoption: Growing interest from institutional investors, including hedge funds and financial institutions, signals a shift towards broader acceptance of XRP. Larger players entering the market inject liquidity and drive up demand.

-

Growing Demand for Cross-Border Payment Solutions: XRP's core function as a facilitator of fast and low-cost cross-border payments is increasingly attractive to businesses and individuals seeking efficient international transactions. This growing demand fuels its price appreciation.

-

Bullish Market Sentiment: The overall positive sentiment in the cryptocurrency market, fueled by positive news in other cryptocurrencies and broader economic factors, has spilled over into XRP, further driving its price upwards.

-

Technical Analysis: Technical indicators, such as breakouts from key resistance levels and increasing trading volume, have also suggested a strong upward trend for XRP, attracting both short-term and long-term investors.

Understanding Market Volatility and Risk

Investing in cryptocurrencies like XRP inherently involves significant risk. The market is highly volatile, meaning prices can fluctuate dramatically in short periods. This volatility can lead to substantial gains, but also significant losses.

-

Risk of Significant Losses: A sudden market correction or negative news could easily reverse the recent gains, potentially resulting in substantial losses for investors.

-

Diversification is Crucial: Never put all your eggs in one basket. Diversifying your investment portfolio across different asset classes, including other cryptocurrencies, stocks, and bonds, is essential to mitigate risk.

-

External Factors: Regulatory changes, economic downturns, and even social media trends can significantly influence XRP's price. These external factors are difficult to predict and can impact investment outcomes.

-

Thorough Research is Paramount: Before investing in any cryptocurrency, including XRP, conduct thorough research to understand the underlying technology, the project's potential, and the associated risks.

XRP Price Prediction and Future Outlook

Short-Term Price Projections (Next 3-6 Months)

Predicting cryptocurrency prices with certainty is impossible. However, analyzing expert opinions and market trends can offer insights into potential short-term scenarios:

-

Bullish Scenarios: Continued positive legal developments, increased institutional adoption, and sustained positive market sentiment could lead to further price increases in the next 3-6 months.

-

Bearish Scenarios: A negative court ruling, regulatory crackdown, or a general market downturn could trigger a significant price correction. Technical analysis suggests potential resistance levels that could cap further price increases in the short term.

-

Charts and Graphs: Analyzing historical price charts and comparing them to current market conditions can provide a visual representation of potential short-term price movements (Note: Actual charts and graphs would be included here in a published article).

Long-Term Price Projections (Next 1-5 Years)

The long-term potential of XRP hinges on several factors:

-

Technological Adoption: Widespread adoption of XRP's technology by financial institutions and businesses for cross-border payments could drive significant long-term growth.

-

Market Competition: The competitive landscape of cryptocurrencies is constantly evolving. The ability of XRP to maintain its competitive edge will influence its long-term success.

-

Regulatory Hurdles: Future regulatory decisions around cryptocurrencies globally will inevitably impact XRP's price and adoption. Navigating these regulatory challenges will be crucial for long-term success.

-

Global Financial System Integration: The potential for XRP to become a significant player in the global financial system represents a major long-term growth driver.

Is It Too Late to Buy XRP? A Balanced Perspective

Arguments for Buying XRP Now

-

Further Growth Potential: Despite the recent surge, the potential for further growth remains, particularly if positive legal developments continue and market sentiment stays positive.

-

Relative Value: The current price, while higher than it was three months ago, may still represent a relatively lower entry point compared to its potential peak, offering a potentially cheaper investment opportunity than before.

-

Long-Term Investment Potential: The long-term potential of XRP as a facilitator of international payments remains a compelling argument for long-term investors despite recent price increases.

Arguments Against Buying XRP Now

-

High Risk: Investing in XRP, like any cryptocurrency, carries a high degree of risk. Significant price drops are always possible.

-

Market Correction Potential: The recent price surge makes a correction likely. A significant price drop could wipe out recent gains.

-

Regulatory Uncertainty: Regulatory developments could significantly impact XRP's future price. Uncertainty surrounding regulations poses a considerable risk.

Practical Considerations for Investing in XRP

-

Invest Responsibly: Only invest an amount you can afford to lose completely.

-

Diversify: Spread your investments across various asset classes to minimize risk.

-

Secure Exchanges: Use reputable and secure cryptocurrency exchanges to store and trade XRP.

-

Due Diligence: Conduct thorough research and understand the risks involved before investing.

Conclusion

The recent 400% XRP gain has undeniably generated excitement, prompting many to question the timing of investment. While market volatility is inherent, and a price correction is plausible, XRP's long-term potential remains attractive for some. Careful research, risk assessment, and a diversified portfolio are crucial before any investment. Whether it's too late to buy XRP depends on your individual risk tolerance, investment strategy, and future market outlook. Always conduct your own due diligence before investing in XRP or any cryptocurrency. Don't miss the opportunity to explore XRP investment prospects further; research thoroughly before committing your capital.

Featured Posts

-

Is Ripple Xrp The Next Millionaire Making Cryptocurrency A Deep Dive

May 01, 2025

Is Ripple Xrp The Next Millionaire Making Cryptocurrency A Deep Dive

May 01, 2025 -

Did Targets Dei Policy Change Cost Them A Look At The Boycotts Impact

May 01, 2025

Did Targets Dei Policy Change Cost Them A Look At The Boycotts Impact

May 01, 2025 -

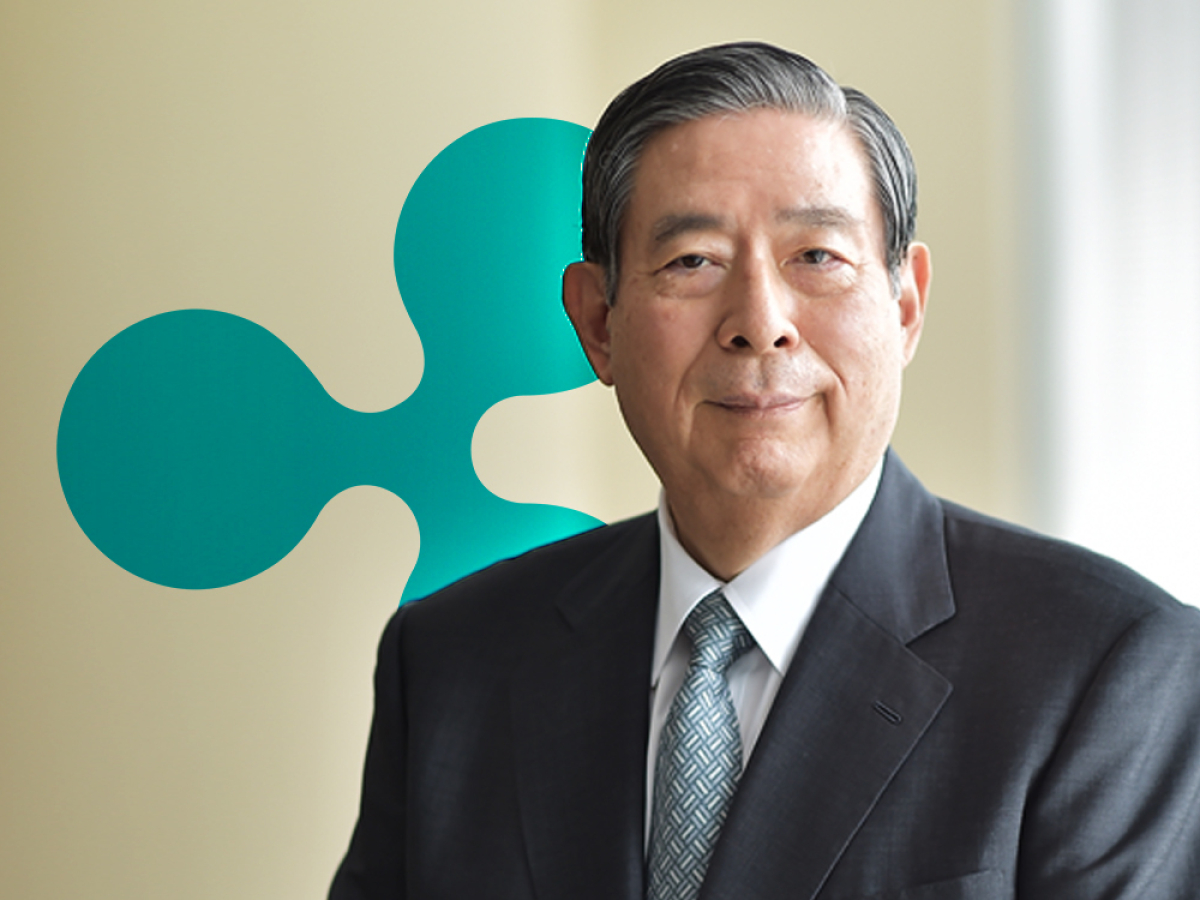

Ripples Xrp In The Spotlight Sbi Holdings And Its Shareholder Rewards Program

May 01, 2025

Ripples Xrp In The Spotlight Sbi Holdings And Its Shareholder Rewards Program

May 01, 2025 -

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomnetaansluiting

May 01, 2025

Juridische Strijd Kampen Dagvaardt Enexis Voor Stroomnetaansluiting

May 01, 2025 -

Priscilla Pointer Carrie Actress And Daughters Co Star Dies At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Daughters Co Star Dies At 100

May 01, 2025

Latest Posts

-

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025 -

The Death Of A Dallas And 80s Soap Star

May 01, 2025

The Death Of A Dallas And 80s Soap Star

May 01, 2025 -

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025 -

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025