3-Year Stock Prediction: Will These Two Stocks Outpace Palantir?

Table of Contents

The stock market's volatility in recent times has left many investors questioning where to place their bets. Palantir, a prominent data analytics company, has experienced its own share of ups and downs. But can other companies outperform this established player in the next three years? This article will analyze the potential of two companies, Nvidia (NVDA) and Microsoft (MSFT), to outperform Palantir (PLTR) over the next three years, considering various fundamental and growth factors. We’ll delve into a 3-year stock prediction for each, examining their potential to deliver superior returns.

H2: Nvidia (NVDA): A Deep Dive into its 3-Year Growth Potential

H3: Fundamental Analysis of Nvidia:

Nvidia, a leading designer of graphics processing units (GPUs), enjoys a dominant market position in gaming, data centers, and artificial intelligence. Its financial strength is undeniable:

- Revenue growth projections for the next three years: Analysts predict strong continued growth, driven by the increasing demand for high-performance computing in AI, autonomous vehicles, and cloud computing. Conservative estimates suggest a compound annual growth rate (CAGR) of 15-20%.

- Profitability analysis (margins, EPS): Nvidia boasts high gross and operating margins, reflecting its strong pricing power and efficient operations. Earnings per share (EPS) are expected to show consistent growth, further bolstering its attractiveness to investors.

- Debt-to-equity ratio and financial health: Nvidia maintains a healthy balance sheet with low debt, providing financial flexibility for future investments and acquisitions.

- Competitive landscape and market share: While competition exists, Nvidia's technological leadership and strong brand recognition allow it to maintain a significant market share.

- Key Financial Metrics Summary: High revenue growth, expanding margins, robust EPS growth, and low debt-to-equity ratio point to a strong financial outlook.

H3: Growth Catalysts for Nvidia:

Several factors contribute to Nvidia's optimistic 3-year stock prediction:

- New product launches and expansions: Continued innovation in GPU technology, expansion into new markets (e.g., robotics), and strategic partnerships will fuel future growth.

- Strategic partnerships and acquisitions: Nvidia actively collaborates with leading tech companies and selectively acquires promising startups to enhance its technology portfolio and expand its market reach.

- Market trends and opportunities: The booming AI market, the rise of the metaverse, and the increasing adoption of cloud computing are major tailwinds for Nvidia's growth.

- Management team and their expertise: Nvidia's experienced management team has a proven track record of innovation and strategic decision-making.

- Positive Growth Factors Summary: Innovation, strategic partnerships, favorable market trends, and strong leadership all contribute to a positive growth outlook.

H3: Risks and Challenges Facing Nvidia:

Despite the positive outlook, several potential challenges need consideration:

- Potential economic downturns: A global recession could negatively impact consumer spending on gaming and other discretionary products.

- Competition from established players: Intel and AMD remain strong competitors in the GPU market, posing a constant challenge.

- Regulatory hurdles: Increased scrutiny from regulators regarding antitrust concerns could limit Nvidia's growth.

- Technological disruptions: The emergence of disruptive technologies could threaten Nvidia's dominance in the market.

- Potential Headwinds Summary: Economic uncertainty, competition, regulation, and technological disruption pose significant risks.

H2: Microsoft (MSFT): Assessing its 3-Year Outlook Against Palantir

H3: Fundamental Analysis of Microsoft:

Microsoft’s diverse portfolio, including cloud computing (Azure), software (Office 365), and gaming (Xbox), provides a strong foundation for sustained growth:

- (Mirror the structure of Nvidia's analysis): Analyze revenue projections, profitability, financial health, competitive landscape, and key metrics. Highlight Microsoft's strong cash flow and consistent dividend payouts.

H3: Growth Catalysts for Microsoft:

Microsoft's growth is fueled by several key factors:

- (Mirror the structure of Nvidia's analysis): Discuss Azure's continued expansion, the growth of Microsoft 365, strategic acquisitions, and its position in the metaverse.

H3: Risks and Challenges Facing Microsoft:

Despite its strengths, Microsoft faces potential hurdles:

- (Mirror the structure of Nvidia's analysis): Discuss competition from Amazon Web Services (AWS) and Google Cloud, regulatory challenges, and potential cybersecurity threats.

H2: Comparative Analysis: Nvidia, Microsoft, and Palantir

This section will compare key metrics (revenue growth, profitability, valuation, etc.) of Nvidia, Microsoft, and Palantir using a table to highlight their strengths and weaknesses. The analysis will consider market sentiment and investor expectations to provide a comprehensive picture.

| Company | Revenue Growth (Projected 3-Year CAGR) | Profitability (Margins) | Valuation | Strengths | Weaknesses |

|---|---|---|---|---|---|

| Nvidia (NVDA) | 15-20% | High | High | Technological leadership, strong market position | Dependence on consumer spending, regulatory risk |

| Microsoft (MSFT) | 10-15% | High | High | Diversified portfolio, strong cash flow | Competition in cloud computing, cybersecurity risk |

| Palantir (PLTR) | 10-15% (Variable) | Variable | Medium-High | Big Data Analytics Expertise | Dependence on government contracts, competition |

H2: Making Informed Investment Decisions: Will Nvidia and Microsoft Outpace Palantir?

Based on our analysis, both Nvidia and Microsoft demonstrate strong potential to outperform Palantir over the next three years. Nvidia's position in the booming AI market and Microsoft's diverse portfolio offer compelling growth opportunities. However, it's crucial to remember that stock market predictions are inherently uncertain. Economic downturns, unexpected technological disruptions, and shifts in market sentiment can significantly impact stock performance. This analysis is not financial advice. Conduct thorough due diligence, consider your risk tolerance, and consult a financial advisor before making any investment decisions. Use this 3-year stock prediction as a starting point for your own research into "Palantir analysis" and broader "stock market investment" strategies. Remember to factor in your individual "long-term investment" goals and risk assessment when evaluating potential investments like those outlined in this "3-year stock prediction" analysis.

Featured Posts

-

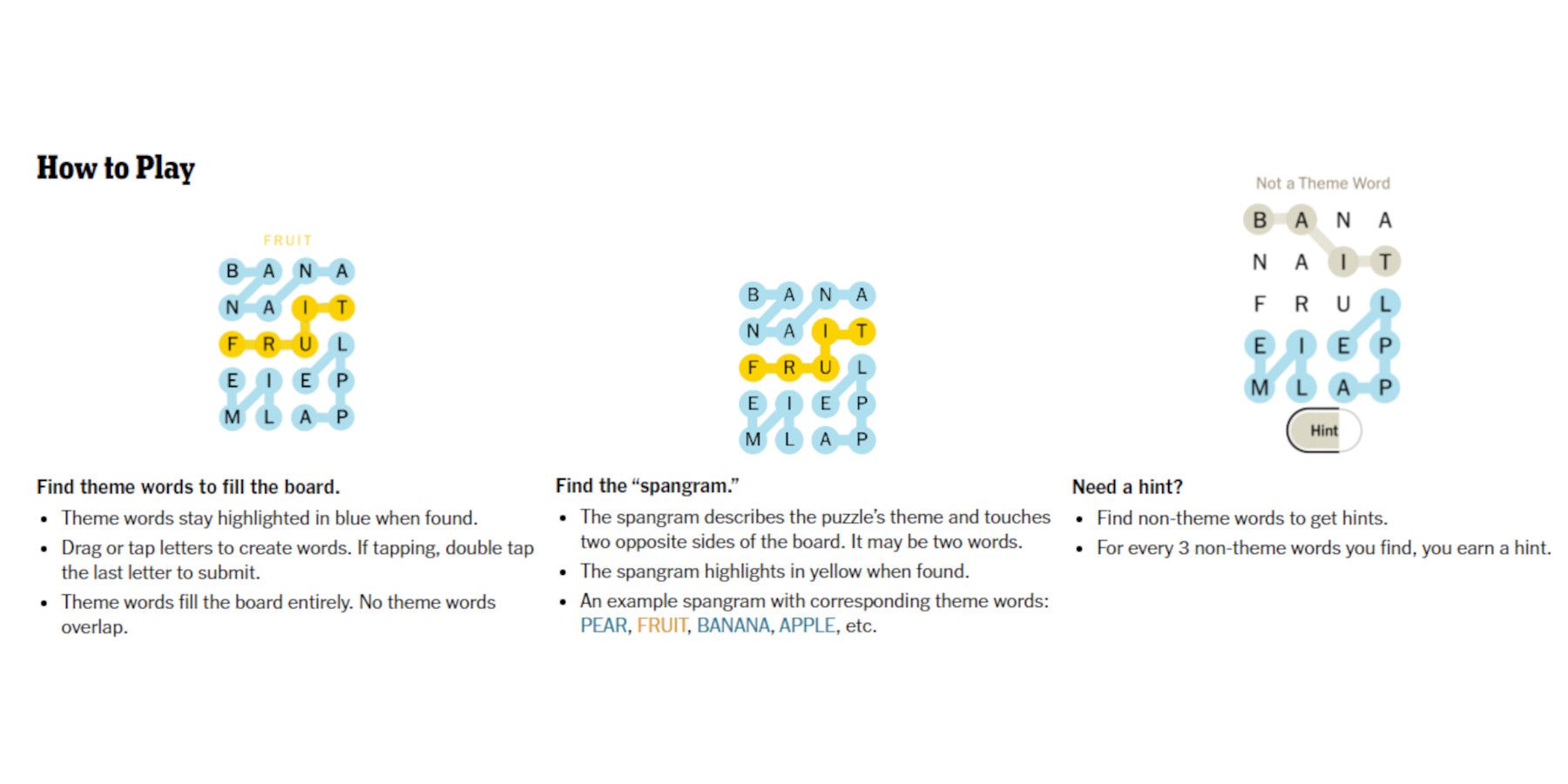

Nyt Strands Game 376 Solutions Friday March 14 Hints And Answers

May 09, 2025

Nyt Strands Game 376 Solutions Friday March 14 Hints And Answers

May 09, 2025 -

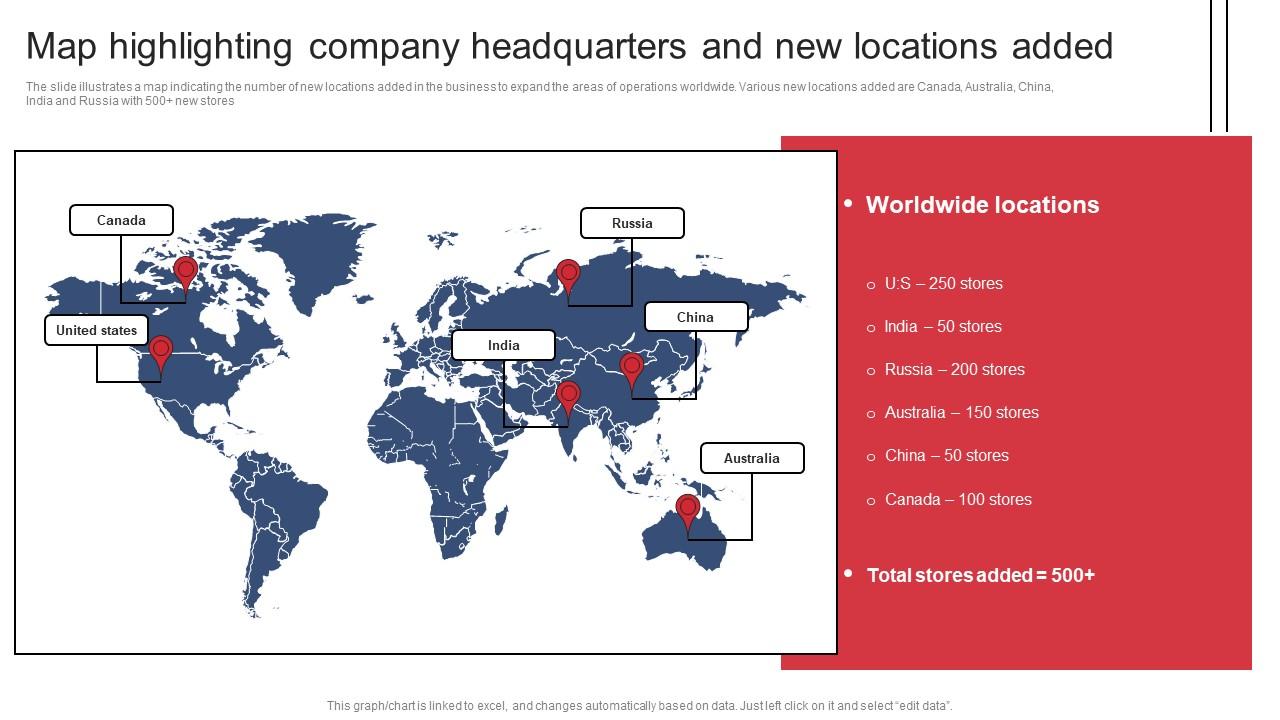

Identifying The Countrys Next Big Business Locations

May 09, 2025

Identifying The Countrys Next Big Business Locations

May 09, 2025 -

Hargreaves Predicts Arsenal Psg Champions League Showdown

May 09, 2025

Hargreaves Predicts Arsenal Psg Champions League Showdown

May 09, 2025 -

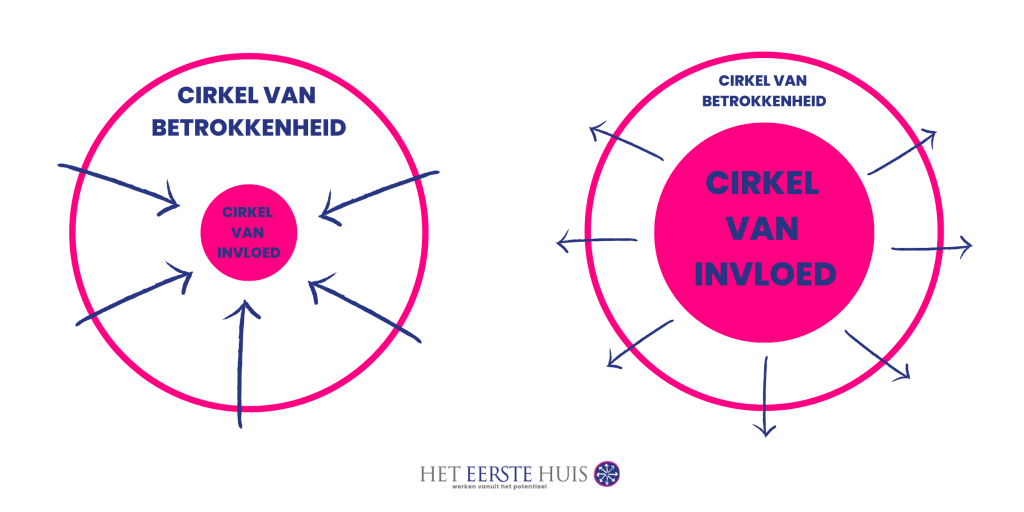

Brekelmans Betrokkenheid Bij India Economische En Politieke Aspecten

May 09, 2025

Brekelmans Betrokkenheid Bij India Economische En Politieke Aspecten

May 09, 2025 -

Elon Musks Wealth Explodes Teslas Rise Post Dogecoin Announcement

May 09, 2025

Elon Musks Wealth Explodes Teslas Rise Post Dogecoin Announcement

May 09, 2025