£3 Billion Slash To SSE Spending: Implications For Energy Investments

Table of Contents

Impact on Renewable Energy Projects

The £3 billion reduction in SSE spending will undoubtedly impact renewable energy projects across the UK. The potential delay or cancellation of numerous wind, solar, and other green energy initiatives is a significant concern. This directly threatens the UK's ambitious renewable energy targets and its commitment to combating climate change.

- Specific Projects Affected: While SSE hasn't publicly specified which projects will be affected, the scale of the cut suggests several large-scale renewable energy developments could face delays or complete cancellation. This uncertainty creates ripples throughout the industry.

- Impact on Net-Zero Targets: The UK's commitment to achieving net-zero emissions by 2050 relies heavily on substantial investments in renewable energy sources. The SSE spending cuts jeopardize the timely deployment of these crucial projects, potentially setting back the nation's climate goals.

- Job Losses and Economic Consequences: The reduction in renewable energy investment translates directly into job losses across the sector. From engineers and construction workers to supply chain businesses, thousands of jobs are at risk, impacting local economies and national employment figures. This also impacts the growth of a vital, future-focused industry.

- Supply Chain Disruptions: The knock-on effect on businesses within the renewable energy supply chain will be substantial. Companies supplying materials, equipment, and services to renewable energy projects will experience reduced demand, potentially leading to further job losses and business failures.

Consequences for Energy Grid Infrastructure

Upgrading and maintaining the UK's electricity grid infrastructure is crucial for accommodating the increasing amount of renewable energy generation and ensuring reliable power supply. The SSE spending cut poses a significant threat to these vital upgrades.

- Delays in Grid Modernization: The lack of investment will inevitably lead to delays in modernizing and expanding the electricity grid. This will hinder the integration of new renewable energy sources and potentially lead to bottlenecks in the energy system.

- Increased Risk of Power Outages: Deferred maintenance and a lack of investment in grid upgrades increase the risk of power outages and grid instability. This poses a significant threat to both businesses and consumers.

- Impact on Energy Supply Reliability and Security: Underinvestment in grid infrastructure compromises the reliability and security of the UK's electricity supply. This vulnerability can have far-reaching economic and social consequences.

- Potential Increase in Energy Costs: Delays in grid maintenance and modernization can lead to increased costs for consumers, as inefficiencies and potential outages drive up energy prices.

Wider Economic Implications of the SSE Spending Cut

The consequences of the SSE spending cut extend far beyond the energy sector, impacting investor confidence and the broader UK economy.

- Impact on Investor Confidence: The decision by SSE to slash its investment budget signals a lack of confidence in the UK energy market. This could deter further investment, both domestically and internationally, hindering the growth of the sector.

- Knock-on Effects on Related Industries: The reduced investment in the energy sector will have knock-on effects on related industries, such as manufacturing, construction, and engineering, leading to job losses and reduced economic activity.

- Government Policy Responses: The government will need to respond to the implications of this significant spending cut. This could involve reviewing energy policies, offering financial incentives, or exploring alternative investment strategies.

- Comparison with Other Countries: The UK's reduced energy investment compared to other countries could put the nation at a competitive disadvantage in the global green energy market.

Alternative Investment Strategies & Opportunities

The reduced SSE spending presents opportunities for other energy companies and investors to step in and fill the gap. This could involve attracting foreign investment or focusing on specific renewable energy projects or grid modernization initiatives. SSE may also refocus its investments on different areas within the energy sector.

Conclusion: Navigating the Future of UK Energy Investment After the SSE Spending Cut

The £3 billion reduction in SSE spending has significant implications for renewable energy projects, energy grid infrastructure, and the wider UK economy. The potential delays in achieving net-zero targets, increased risk of power outages, and negative impact on investor confidence are serious concerns. The government and other investors must work together to address these challenges and ensure continued investment in the UK energy sector to meet climate goals and secure a reliable and affordable energy supply. Stay informed about the evolving landscape of UK energy investment by following our blog and subscribing to our newsletter. Learn more about the impact of the SSE spending cuts on renewable energy projects and the future of the energy sector.

Featured Posts

-

Tov Z Odnim Uchasnikom Plyusi Ta Minusi Gospodaryuvannya

May 23, 2025

Tov Z Odnim Uchasnikom Plyusi Ta Minusi Gospodaryuvannya

May 23, 2025 -

Where To Find The Best Memorial Day Appliance Sales 2025 Forbes

May 23, 2025

Where To Find The Best Memorial Day Appliance Sales 2025 Forbes

May 23, 2025 -

Anonymity At Trumps Exclusive Memecoin Dinner

May 23, 2025

Anonymity At Trumps Exclusive Memecoin Dinner

May 23, 2025 -

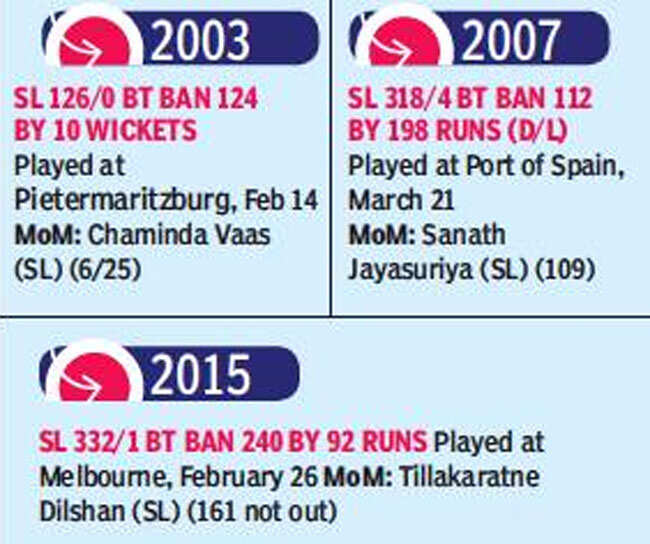

First Test Bangladeshs Resurgence Against Zimbabwe

May 23, 2025

First Test Bangladeshs Resurgence Against Zimbabwe

May 23, 2025 -

Zimbabwe Vs Bangladesh Shadman Islams Impressive Performance

May 23, 2025

Zimbabwe Vs Bangladesh Shadman Islams Impressive Performance

May 23, 2025

Latest Posts

-

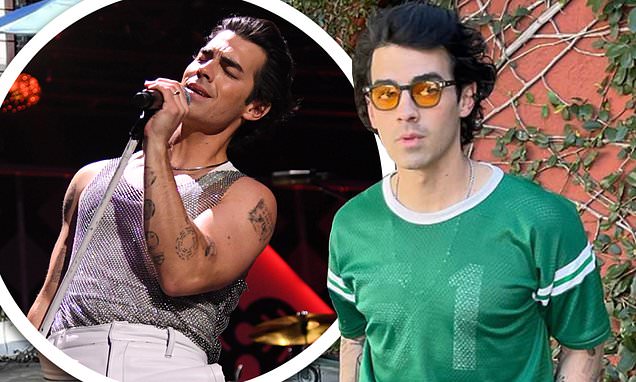

Joe Jonass Hilarious Response To A Couples Fight Over Him

May 23, 2025

Joe Jonass Hilarious Response To A Couples Fight Over Him

May 23, 2025 -

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025 -

Joe Jonas Reacts To Married Couple Arguing About Him

May 23, 2025

Joe Jonas Reacts To Married Couple Arguing About Him

May 23, 2025 -

Joe Jonass Hilarious Response To Couples Fight Over Him

May 23, 2025

Joe Jonass Hilarious Response To Couples Fight Over Him

May 23, 2025 -

Neal Mc Donoughs Impact On The Last Rodeo

May 23, 2025

Neal Mc Donoughs Impact On The Last Rodeo

May 23, 2025