$3 Billion Loan Cancellation: Sunnova Energy And The Trump Administration

Table of Contents

Sunnova Energy's Financial Situation Before the Loan Cancellation

Sunnova Energy International, Inc. is a leading residential solar energy provider, operating under a business model that involves leasing or financing solar panel systems to homeowners. Before the loan cancellation, however, Sunnova was facing significant financial challenges. Their high debt levels, coupled with fluctuating revenue streams dependent on the volatile renewable energy market, raised serious investor concerns. The company's precarious financial position made securing additional funding crucial for its survival.

- High Debt Levels: Sunnova carried substantial debt, impacting its credit rating and limiting its access to traditional financing.

- Dependence on Government Programs: Sunnova, like many renewable energy companies, relied heavily on government loan programs and subsidies for growth. Any changes or reductions in these programs could significantly jeopardize the company’s stability.

- Investor Uncertainty: The company’s financial struggles caused considerable uncertainty among investors, resulting in fluctuating stock prices and increased financial risk.

- Previous Financial Aid: While details are not publicly readily available about previous aid, it's known the company sought and leveraged various financial instruments before receiving the substantial $3 billion loan cancellation.

These factors created a situation where Sunnova was in dire need of substantial financial assistance to remain afloat. Understanding Sunnova Energy debt and its precarious financial standing before the cancellation is key to analyzing the Trump administration's decision. Keywords like Sunnova Energy financials, solar loan programs, and renewable energy financing are essential to grasping the full context.

The Trump Administration's Rationale for the Loan Cancellation

The Trump administration justified the $3 billion loan cancellation by citing several key arguments. They emphasized the potential for significant job creation within the renewable energy sector, arguing that the cancellation would protect thousands of jobs and stimulate economic growth. The administration also claimed that the move would encourage further investment in renewable energy technologies, contributing to the nation’s energy independence.

- Job Preservation: The primary argument focused on preventing widespread job losses within Sunnova and its supply chain.

- Stimulating Renewable Energy: The cancellation was framed as a necessary investment to propel the growth of the U.S. renewable energy sector.

- Political Influence: Critics pointed to potential political motivations, suggesting lobbying efforts by Sunnova or its affiliates played a significant role in the decision.

- Lack of Transparency: The decision-making process surrounding the cancellation lacked transparency, fueling accusations of favoritism and misuse of taxpayer funds.

Keywords like Trump administration policy, renewable energy subsidies, and government loan forgiveness are crucial for understanding the administration’s stated reasoning. However, the lack of readily available transparent documentation and conflicting reports surrounding the decision makes it difficult to definitively assess the true motivations.

The Public Reaction and Controversy Surrounding the Loan Cancellation

The public response to the $3 billion loan cancellation was immediate and overwhelmingly negative. Many criticized the decision as a blatant example of corporate welfare, accusing the Trump administration of prioritizing the interests of a specific company over the concerns of taxpayers. Accusations of political corruption and misuse of taxpayer money dominated the public discourse.

- Public Outrage: News outlets and social media were flooded with expressions of anger and disbelief over the use of taxpayer funds.

- Legal Challenges: Several legal challenges and investigations were launched, scrutinizing the legality and ethics of the loan cancellation.

- Government Transparency Concerns: The lack of transparency surrounding the decision further fueled public distrust in government institutions.

- Divergent Opinions: While some argued the cancellation was economically necessary to protect jobs and the renewable energy sector, many others condemned it as a wasteful and unfair use of taxpayer money.

Keywords such as taxpayer money, government transparency, political corruption, public outrage, and financial scandal aptly describe the reaction and the ensuing controversy.

Long-Term Impacts of the $3 Billion Loan Cancellation on Sunnova Energy and the Renewable Energy Sector

The long-term consequences of the $3 billion loan cancellation remain to be fully seen. While Sunnova Energy experienced a short-term boost in financial stability, the long-term effects on its performance and the wider renewable energy market are complex and multifaceted.

- Sunnova Energy's Performance: The cancellation undoubtedly improved Sunnova's short-term financial outlook, allowing the company to continue operations and pursue growth opportunities.

- Investor Confidence: The event's long-term impact on investor confidence in the renewable energy sector is uncertain, as some might view government intervention as a positive, while others might view it as indicative of market fragility.

- Government Loan Programs: The cancellation set a precedent, raising concerns about the future of government loan programs and investment in renewable energy.

- Industry Trends: The incident highlighted the complexities and risks associated with the renewable energy sector and the role of government intervention.

Keywords such as renewable energy investment, solar industry growth, government regulations, and long-term financial impact are essential in understanding the lasting implications of this decision.

Conclusion: Assessing the Legacy of the Sunnova Energy Loan Cancellation

The $3 billion loan cancellation to Sunnova Energy remains a highly controversial event, raising serious questions about the use of taxpayer money, government transparency, and the role of political influence in economic policy. While the Trump administration presented arguments about job preservation and stimulating the renewable energy sector, critics have highlighted the lack of transparency, potential for corruption, and the setting of a troubling precedent for future government interventions. The long-term consequences for both Sunnova and the renewable energy sector are still unfolding, but the incident serves as a stark reminder of the complexities and challenges involved in balancing economic interests with public accountability. To gain a deeper understanding, further research is encouraged. Investigate relevant sources, such as government reports, news articles, and financial analyses, to form your own informed opinion on this controversial "$3 Billion Loan Cancellation" and its lasting effects.

Featured Posts

-

Grab Your Tickets James Arthurs Manchester Concert And Uk Tour 2026

May 30, 2025

Grab Your Tickets James Arthurs Manchester Concert And Uk Tour 2026

May 30, 2025 -

Madden Nfl Rob Manfreds Mlb Ownership Crisis

May 30, 2025

Madden Nfl Rob Manfreds Mlb Ownership Crisis

May 30, 2025 -

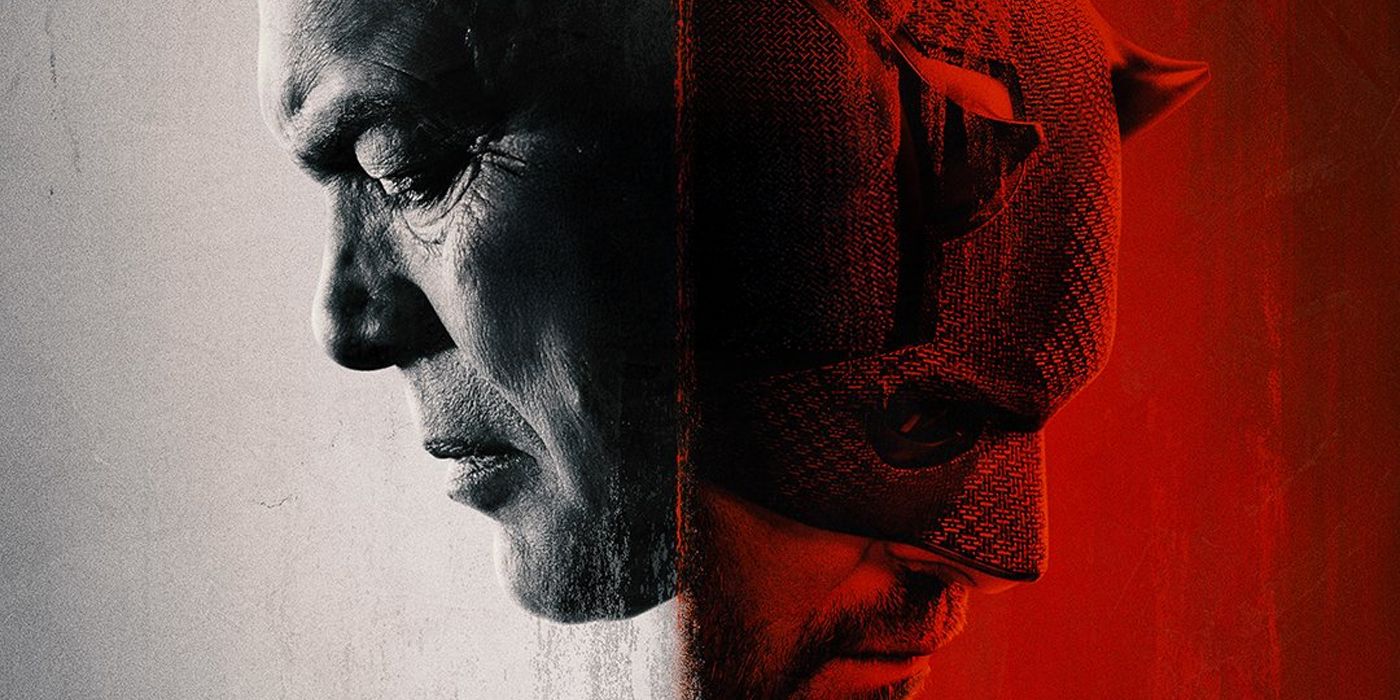

The Cut White Tiger Scene From Daredevil Born Again Episode 4 Explained

May 30, 2025

The Cut White Tiger Scene From Daredevil Born Again Episode 4 Explained

May 30, 2025 -

Reembolso Ticketmaster Guia Para El Festival Axe Ceremonia 2025 Cancelado

May 30, 2025

Reembolso Ticketmaster Guia Para El Festival Axe Ceremonia 2025 Cancelado

May 30, 2025 -

Autoroute A69 Le Gouvernement Tente De Relancer Les Travaux

May 30, 2025

Autoroute A69 Le Gouvernement Tente De Relancer Les Travaux

May 30, 2025

Latest Posts

-

Orange County Sports Game Results And Player Performance For March 11th

May 31, 2025

Orange County Sports Game Results And Player Performance For March 11th

May 31, 2025 -

Orange County Scores And Player Stats Tuesday March 11th

May 31, 2025

Orange County Scores And Player Stats Tuesday March 11th

May 31, 2025 -

Thuy Linh Hanh Trinh Day Thu Thach Tai Thuy Si Mo Rong 2025

May 31, 2025

Thuy Linh Hanh Trinh Day Thu Thach Tai Thuy Si Mo Rong 2025

May 31, 2025 -

May 23rd Orange County Sports Recap Scores And Player Performance

May 31, 2025

May 23rd Orange County Sports Recap Scores And Player Performance

May 31, 2025 -

Cau Long Thuy Linh Kho Khan Ngay Vong Loai Thuy Si Mo Rong 2025

May 31, 2025

Cau Long Thuy Linh Kho Khan Ngay Vong Loai Thuy Si Mo Rong 2025

May 31, 2025