2025 Gold Market: Facing Back-to-Back Weekly Losses

Table of Contents

Understanding the Recent Decline in Gold Prices

The recent dip in gold prices is a complex issue, influenced by a confluence of factors. Let's examine some key contributors to this trend.

Impact of Rising Interest Rates

The relationship between gold prices and interest rates is often inverse. Higher interest rates generally make bonds more attractive to investors, as they offer a fixed return. This increased attractiveness of bonds diverts investment away from non-yielding assets like gold, putting downward pressure on its price.

- Impact on investor sentiment: Rising rates can negatively impact investor confidence in gold, leading to selling pressure.

- Shifting investment strategies: Investors may reallocate funds from gold to higher-yielding investments like bonds and treasury bills.

- Reduced demand for gold as a safe haven asset: During periods of economic stability (relatively speaking), the perceived need for a safe-haven asset like gold diminishes.

Strengthening US Dollar

The US dollar's strength is another significant factor impacting gold prices. Gold is priced in US dollars, so a stronger dollar makes gold more expensive for holders of other currencies, reducing global demand and consequently depressing the price.

- Influence of global economic factors: Global economic conditions significantly impact the dollar's strength, thereby indirectly influencing the gold market.

- Impact on international gold trading: A stronger dollar makes it more expensive for international buyers to purchase gold, leading to decreased demand.

- Expectations for future dollar strength: Market anticipations regarding the future trajectory of the US dollar heavily influence current gold price movements. A predicted strengthening of the dollar often leads to preemptive selling of gold.

Geopolitical Factors and their Uncertain Influence

Geopolitical events play a significant, albeit unpredictable, role in the gold market. While uncertainty often drives investors towards gold as a safe haven, specific events can have varied and sometimes counterintuitive impacts.

- Specific examples of geopolitical events: The ongoing war in Ukraine, tensions in the South China Sea, and trade disputes all contribute to market uncertainty – sometimes driving gold prices up, sometimes down depending on the overall market sentiment and investor reaction.

- Contrasting scenarios and their impact on gold prices: A major geopolitical crisis might initially boost gold prices as investors seek safety, but prolonged uncertainty could lead to selling if investors lose patience waiting for a resolution.

- The role of market speculation: Speculation plays a significant role. Rumors and anticipation of geopolitical events can cause significant fluctuations in gold prices before any concrete events even occur.

Analyzing the Current Gold Market Sentiment

Understanding current market sentiment is crucial for navigating the 2025 gold market. Let's explore investor behavior and market psychology, as well as technical and fundamental analyses.

Investor Behavior and Market Psychology

Recent gold price losses have impacted investor sentiment significantly. The interplay of fear and greed drives much of the market's fluctuations.

- Trends in gold ETF holdings: Observing trends in gold exchange-traded fund (ETF) holdings provides valuable insights into institutional investor behavior and sentiment.

- Changes in investor confidence: Decreasing gold prices can trigger a loss of confidence, leading to further selling, exacerbating the downward trend. Conversely, a positive catalyst can quickly reverse this sentiment.

- Impact of media coverage on gold market perception: Media narratives and expert opinions significantly influence overall market perception, potentially impacting investor decisions and driving price fluctuations.

Technical Analysis of Gold Charts

Technical analysis uses past price and volume data to predict future price movements. (Note: Charts would ideally be included here in a full article.) Analyzing charts reveals potential support and resistance levels, offering insights into potential price targets and turning points.

- Key technical indicators: Moving averages, relative strength index (RSI), and other indicators help identify trends and potential reversals.

- Potential price targets: Based on chart patterns and technical analysis, potential price targets can be identified, providing insights into possible future price ranges.

- Interpretation of chart patterns: Identifying patterns like head and shoulders, double tops/bottoms, and triangles can offer clues about potential future price movements.

Fundamental Analysis of Gold's Intrinsic Value

Fundamental analysis focuses on the intrinsic value of gold, independent of market sentiment.

- Supply and demand dynamics: The balance between gold supply (mining production, recycling) and demand (jewelry, investment, industrial uses) fundamentally affects its price.

- Inflation expectations: Gold is often seen as a hedge against inflation. High inflation expectations usually drive demand, increasing gold prices.

- Central bank gold holdings: Central banks' buying and selling activities significantly impact the overall supply and demand dynamics and influence gold prices.

Potential Future Outlook for the 2025 Gold Market

Predicting gold price movements with absolute certainty is impossible. However, by considering various factors, we can speculate on potential future scenarios.

Predicting Gold Price Movements

While a definitive 2025 gold price prediction is impossible, several scenarios are plausible:

- Potential scenarios for gold price movements: A continued decline, a sideways consolidation, or a potential rebound are all possible depending on the interplay of the factors discussed above.

- Factors influencing price predictions: Interest rate decisions by central banks, the strength of the US dollar, geopolitical developments, and overall investor sentiment are all key determinants.

- Long-term vs. short-term outlook: The long-term outlook for gold might remain positive due to factors like inflation and potential geopolitical instability, even if the short-term outlook appears bearish.

Strategies for Gold Investors in a Volatile Market

In a volatile market, a robust investment strategy is paramount.

- Diversification strategies: Diversifying your investment portfolio beyond just gold is crucial to mitigate risks.

- Hedging techniques: Employing hedging strategies can help protect your portfolio against potential losses.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals helps mitigate the risk of buying high and selling low.

- Holding periods: Consider your investment timeframe; gold is often a long-term investment.

Conclusion

The 2025 gold market is currently experiencing volatility, with recent back-to-back weekly losses highlighting the complex interplay of factors such as interest rates, the US dollar, and geopolitical events. Understanding these dynamics, combined with a thorough analysis of market sentiment and technical indicators, is essential for effective navigation. While predicting the precise trajectory of gold prices remains challenging, a well-diversified investment strategy and robust risk management practices are crucial. Stay informed about 2025 gold market trends, adapt your approach accordingly, and remember to consult with a financial advisor before making any investment decisions. Continue to monitor the 2025 gold market and adjust your gold investment strategy to capitalize on opportunities and mitigate risks.

Featured Posts

-

Fatal Yellowstone Area Accident Seven Killed In Truck And Van Collision

May 05, 2025

Fatal Yellowstone Area Accident Seven Killed In Truck And Van Collision

May 05, 2025 -

Ufc 314 Main Event Odds A Deep Dive Into Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Main Event Odds A Deep Dive Into Volkanovski Vs Lopes

May 05, 2025 -

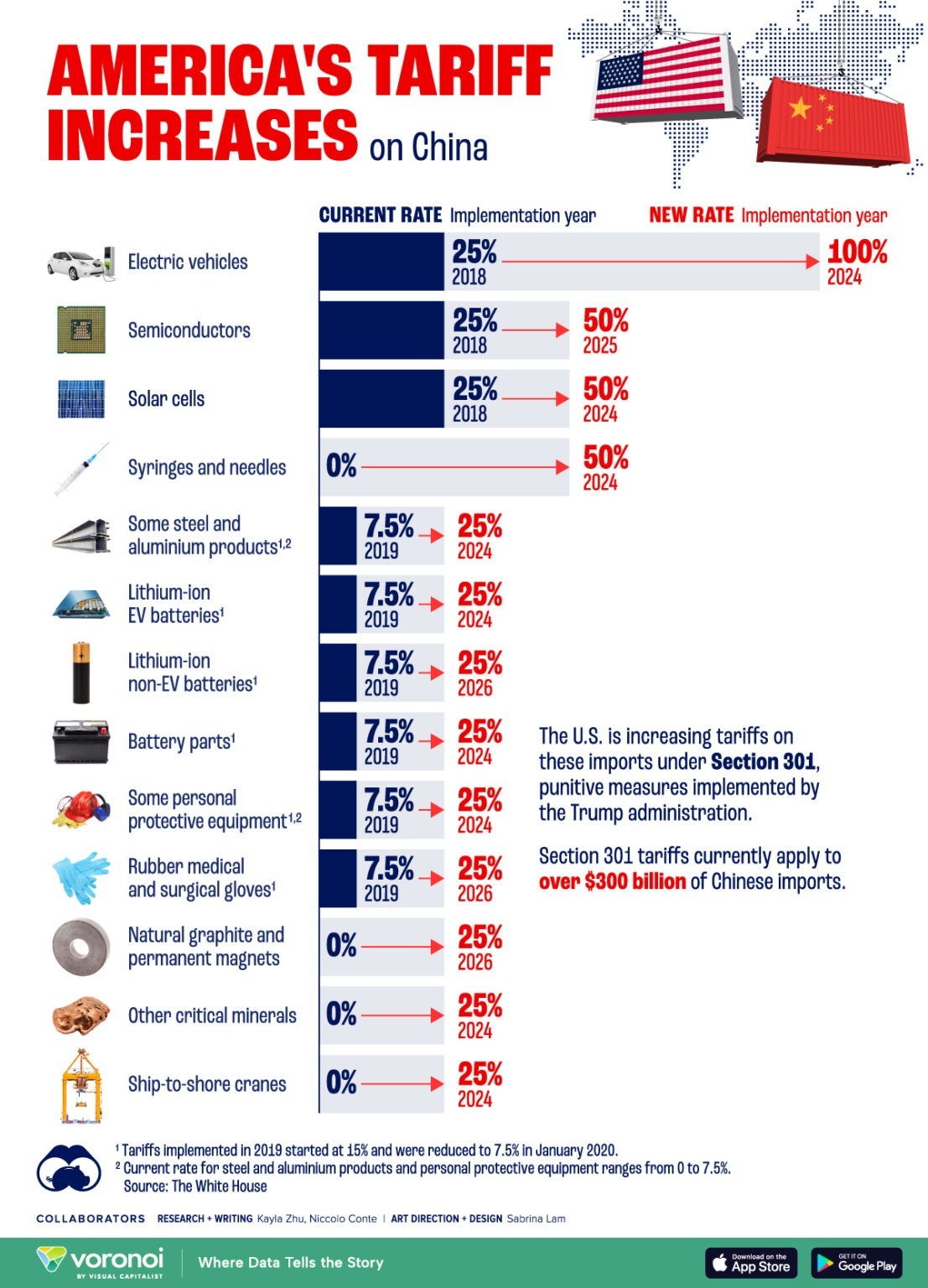

The Future Of Electric Vehicles A Us China Showdown

May 05, 2025

The Future Of Electric Vehicles A Us China Showdown

May 05, 2025 -

Is Marvel Losing Its Way A Look At Needed Improvements

May 05, 2025

Is Marvel Losing Its Way A Look At Needed Improvements

May 05, 2025 -

Aritzias Response To Trump Tariffs No Planned Price Hikes

May 05, 2025

Aritzias Response To Trump Tariffs No Planned Price Hikes

May 05, 2025

Latest Posts

-

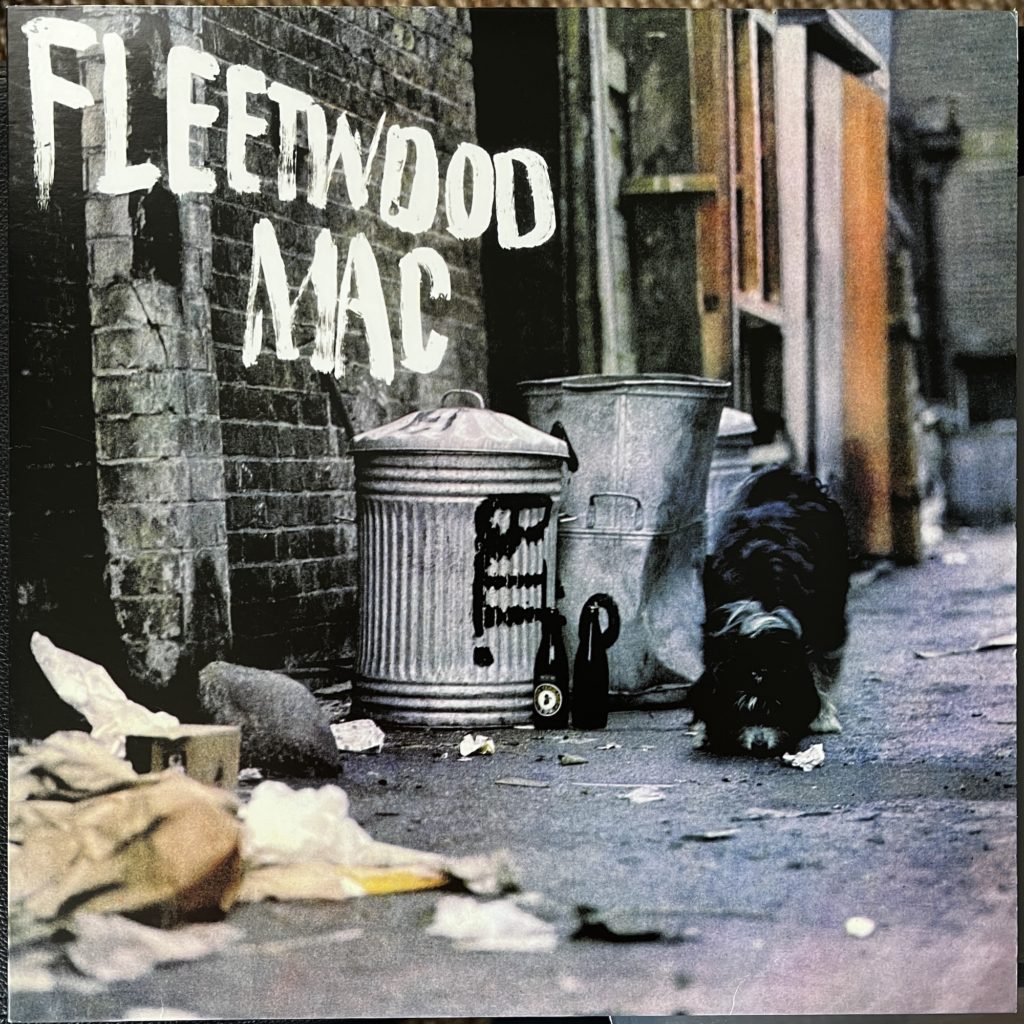

1 The Rocket Peter Greens Defining Moment With Fleetwood Mac

May 05, 2025

1 The Rocket Peter Greens Defining Moment With Fleetwood Mac

May 05, 2025 -

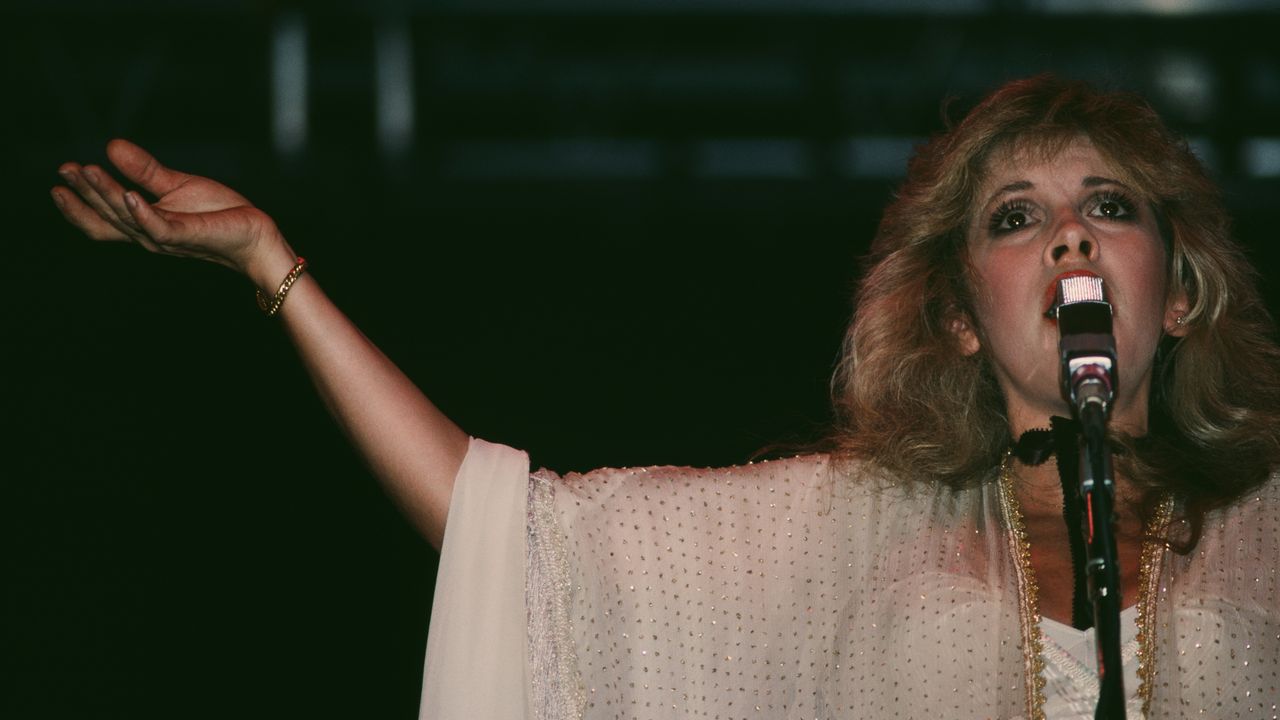

The Enduring Legacy Of Fleetwood Macs Most Popular Songs

May 05, 2025

The Enduring Legacy Of Fleetwood Macs Most Popular Songs

May 05, 2025 -

The Day Peter Green Created Fleetwood Mac The Genesis Of 96 1 The Rocket

May 05, 2025

The Day Peter Green Created Fleetwood Mac The Genesis Of 96 1 The Rocket

May 05, 2025 -

Fleetwood Mac Charting Success With A New Album Of Classic Inspired Tracks

May 05, 2025

Fleetwood Mac Charting Success With A New Album Of Classic Inspired Tracks

May 05, 2025 -

Fleetwood Mac Announces New Album A Retrospective Journey

May 05, 2025

Fleetwood Mac Announces New Album A Retrospective Journey

May 05, 2025