2% LVMH Share Drop Follows Disappointing Q1 Sales Report

Table of Contents

Disappointing Q1 Sales Figures: A Detailed Analysis

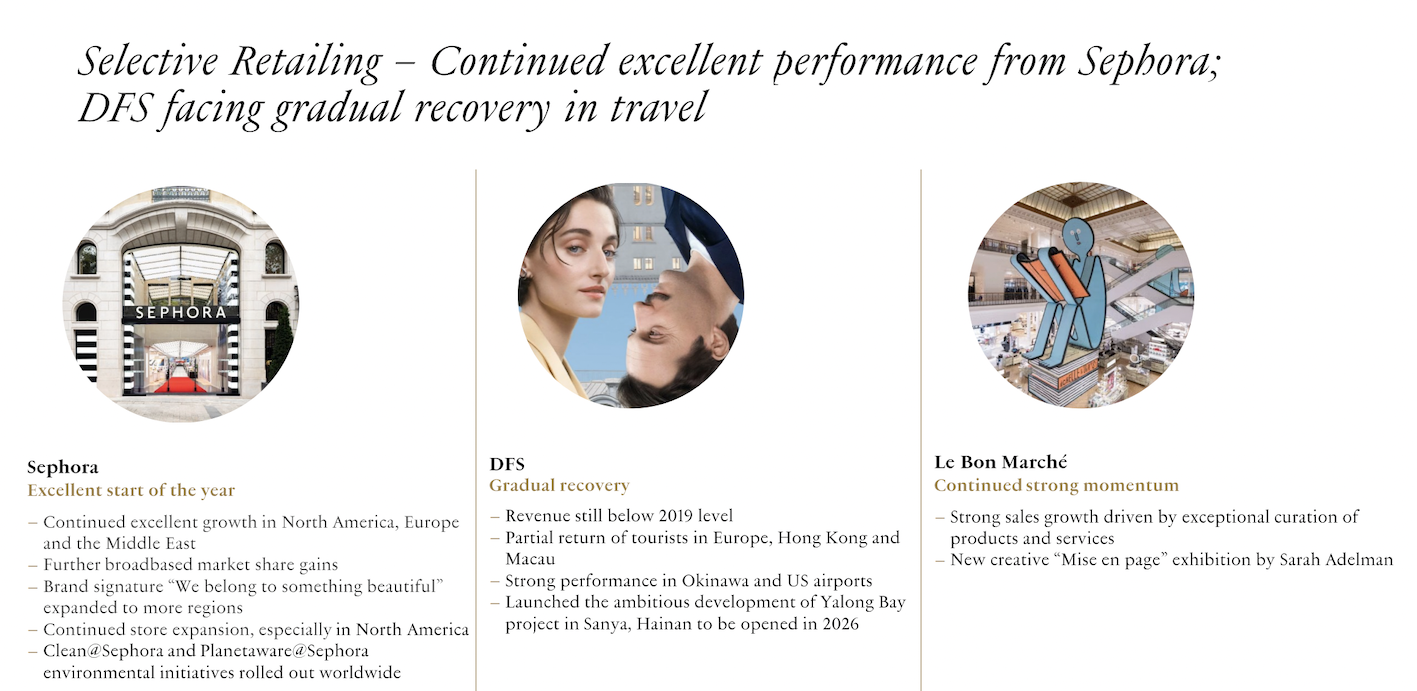

The Q1 2024 sales report revealed a considerable shortfall compared to analysts' expectations and previous quarters, directly contributing to the LVMH share drop.

Sales Growth Below Expectations

LVMH's sales growth significantly lagged behind predictions, falling short by approximately X% compared to analyst forecasts and showing a Y% decrease compared to the same period last year. This underperformance is a primary driver of the recent LVMH stock decline.

- Underperforming Sectors: The Fashion & Leather Goods division experienced a particularly sharp decline, with sales down Z%. The Perfumes & Cosmetics sector also underperformed, showing a W% decrease.

- Sales Figures: Total revenue reached €XX billion (or $YY billion), significantly below the anticipated €ZZ billion.

- Geographical Underperformance: The Asian market, particularly China, showed a marked slowdown in sales growth, contributing substantially to the overall disappointing results and the subsequent LVMH share price fall.

Impact of External Factors

Several external factors contributed to LVMH's weaker-than-expected Q1 performance and subsequent LVMH share drop.

- Inflation and Reduced Consumer Spending: High inflation rates across several key markets reduced consumer disposable income, impacting luxury goods purchases.

- Supply Chain Disruptions: Ongoing global supply chain issues caused delays and increased costs, further squeezing profit margins.

- Geopolitical Instability: Geopolitical uncertainties and the ongoing war in Ukraine created a climate of uncertainty, impacting consumer confidence and luxury spending.

Investor Reaction and Market Impact

The news of LVMH's disappointing Q1 sales triggered an immediate and negative market response, resulting in a substantial LVMH share drop.

Immediate Market Response

The announcement led to an immediate 2% drop in LVMH's share price, wiping billions off its market capitalization. Trading volume spiked significantly on the day of the announcement, reflecting the intense investor interest and concern. Overall market sentiment towards luxury goods showed a downturn following the release of the LVMH report.

Long-Term Implications for LVMH Stock

The LVMH share drop raises concerns about the company's long-term prospects. Investors are now questioning the sustainability of LVMH's growth trajectory, particularly in the face of persistent global economic uncertainty. Analyst predictions vary, with some forecasting a continued slowdown while others anticipate a recovery in the coming quarters. The long-term impact on the LVMH stock price will depend largely on the effectiveness of the company's response and the overall economic climate.

LVMH's Response and Strategies for Recovery

LVMH has responded to the disappointing Q1 results with a combination of strategic adjustments and cost-cutting measures.

Official Statements and Company Actions

LVMH's CEO, Bernard Arnault, acknowledged the challenges faced in Q1, citing external factors such as inflation and geopolitical instability. The company has announced several measures to address the situation, including streamlining operations and focusing on cost efficiencies. While specific details remain limited, they intend to prioritize key growth areas and strengthen their supply chain.

Future Outlook and Growth Prospects

Despite the challenges, LVMH remains optimistic about its long-term growth prospects. The company is focusing on innovation, expanding into new markets, and developing new product lines to maintain its competitive edge. New product launches and strategic market expansions are expected to contribute towards a recovery. The success of these strategies will play a crucial role in determining the future trajectory of the LVMH share price.

Conclusion: Understanding the LVMH Share Drop and its Significance

The 2% LVMH share drop following the disappointing Q1 sales report highlights the vulnerability of even the strongest luxury brands to external economic pressures. Factors like inflation, supply chain disruptions, and geopolitical uncertainty played a significant role in this LVMH stock decline. LVMH's response, focusing on cost efficiency and strategic adjustments, will be critical in determining whether the company can navigate these challenges and regain investor confidence. To stay informed about future developments regarding the LVMH share price and the luxury goods market, subscribe to our newsletter and follow reputable financial news sources. Understanding the nuances of this LVMH share drop is crucial for investors and industry analysts alike.

Featured Posts

-

Facing Retribution The Risks Of Challenging The Status Quo

May 25, 2025

Facing Retribution The Risks Of Challenging The Status Quo

May 25, 2025 -

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025 -

Avrupa Borsalari Ecb Faiz Kararindan Sonra Piyasa Hareketleri

May 25, 2025

Avrupa Borsalari Ecb Faiz Kararindan Sonra Piyasa Hareketleri

May 25, 2025 -

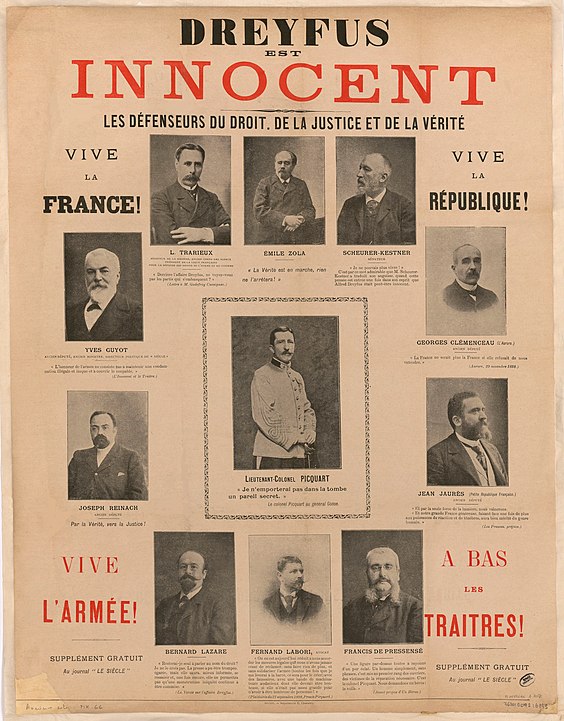

Dreyfus Affair Renewed Calls For Military Promotion 130 Years Later

May 25, 2025

Dreyfus Affair Renewed Calls For Military Promotion 130 Years Later

May 25, 2025 -

Vervolg Snelle Markt Draai Europese Aandelen Tegenover Wall Street

May 25, 2025

Vervolg Snelle Markt Draai Europese Aandelen Tegenover Wall Street

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025