13 Analyst Ratings: Principal Financial Group (PFG) Stock Assessment

Table of Contents

Summary of Analyst Ratings: A Diverse Range of Opinions on PFG Stock

Thirteen analysts have weighed in on Principal Financial Group (PFG) stock, resulting in a spectrum of opinions regarding its future performance. The distribution of these ratings reveals a mixed outlook:

| Rating | Number of Analysts |

|---|---|

| Buy | 5 |

| Hold | 6 |

| Sell | 2 |

(Note: These numbers are hypothetical for illustrative purposes and do not reflect actual current analyst ratings. Always consult up-to-date information from reputable financial sources.)

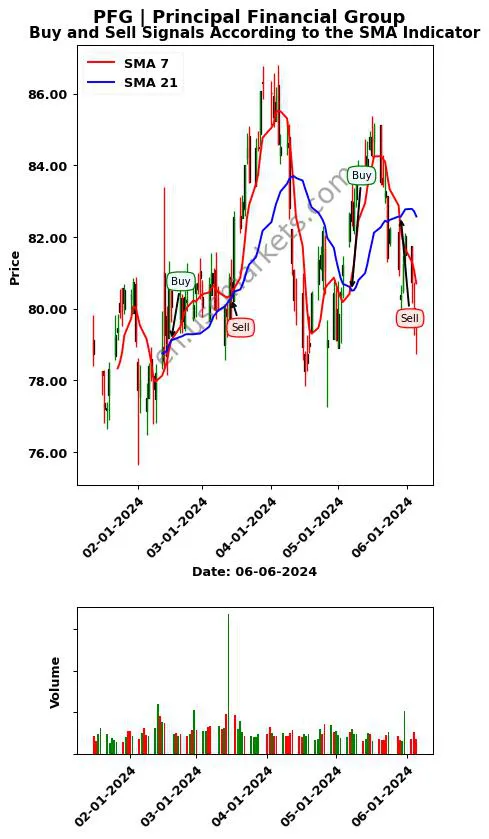

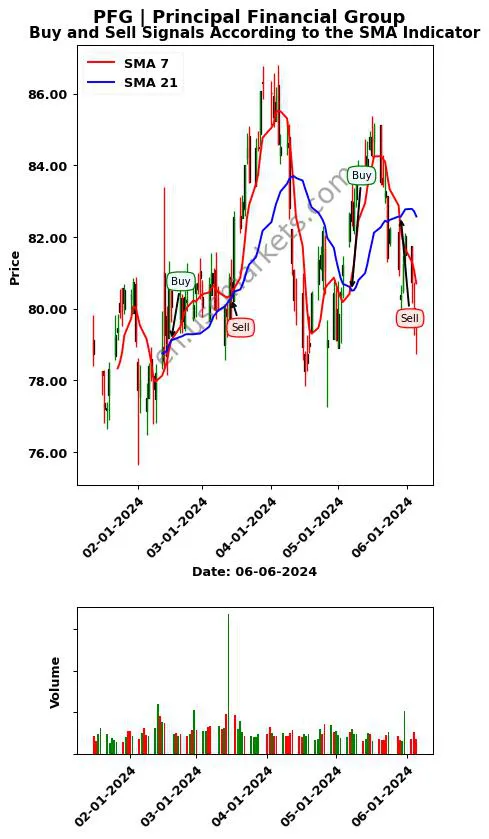

This data is visually represented in the chart below:

(Insert a simple bar chart here showing the distribution of Buy, Hold, and Sell ratings.)

The average price target provided by these analysts stands at [Insert Hypothetical Average Price Target]. This price target reflects analysts' collective expectation of PFG's future stock value. Understanding the distribution of PFG stock price target among analysts provides a nuanced perspective on the potential range of outcomes. Analyzing PFG stock forecast based on these recommendations is crucial for investors seeking to assess the risk and reward associated with this investment. This summary provides a foundational understanding of analyst recommendations (buy rating, sell rating, hold rating) for PFG stock forecast.

Factors Influencing Analyst Ratings: Key Drivers Behind the PFG Stock Assessment

Analyst ratings on PFG stock aren't arbitrary; they stem from a thorough evaluation of several key factors. These include:

- PFG Financial Performance: Analysts meticulously scrutinize PFG's financial statements, focusing on key metrics like revenue growth, earnings per share (EPS), and profitability margins. Recent trends in PFG earnings and PFG revenue are particularly important.

- Macroeconomic Factors: Broader economic conditions, such as interest rate fluctuations, inflation levels, and overall market sentiment, significantly impact PFG's performance. Changes in these macroeconomic factors can directly influence the PFG stock price.

- Competitive Analysis: The competitive landscape within the financial services sector plays a vital role. Analysts assess PFG's competitive advantages and disadvantages relative to its peers.

- Strategic Initiatives: PFG's strategic plans, mergers, acquisitions, and internal initiatives all influence future performance and are carefully examined by analysts.

By analyzing these factors, analysts arrive at a holistic view of PFG's prospects and translate this into buy, hold, or sell recommendations. A deep dive into PFG financial performance, considering both macroeconomic factors and competitive analysis, offers a more complete understanding of the rationale behind the ratings.

Strengths and Weaknesses of PFG: A Balanced Perspective from Analyst Ratings

Analyst ratings offer a balanced perspective, highlighting both the strengths and weaknesses of PFG. Based on their reports:

Strengths:

- Strong Balance Sheet: Many analysts praise PFG's robust financial position, indicating resilience against economic downturns.

- Attractive Dividend Yield: PFG's dividend payout is often cited as a positive aspect for income-seeking investors. Analyzing PFG dividend yield is essential for those prioritizing income streams.

- Growth Potential: Analysts acknowledge PFG's potential for growth within the financial services industry, particularly in specific market segments. Understanding PFG growth potential helps investors to gauge long-term prospects.

Weaknesses:

- Regulatory Risk: The financial services sector is heavily regulated, and regulatory changes can significantly impact PFG's operations and profitability. Assessing regulatory risk is crucial for investors.

- Intense Market Competition: PFG operates in a highly competitive market, which can put pressure on margins and profitability.

- Economic Sensitivity: PFG's performance is susceptible to fluctuations in the broader economy, making it vulnerable during economic downturns. This economic sensitivity should be factored into investment decisions.

A comprehensive understanding of these strengths and weaknesses, supported by evidence from analyst reports and PFG's financial statements, is vital for making informed investment decisions.

Investment Implications: Interpreting the Analyst Ratings for PFG Stock

The mixed sentiment reflected in the 13 analyst ratings suggests a cautious approach to PFG stock. While some analysts hold a bullish outlook (Buy rating), others recommend a more conservative stance (Hold rating), and some even suggest selling (Sell rating).

- For Conservative Investors: A "hold" strategy might be appropriate, given the mixed signals.

- For Aggressive Investors: A "buy" decision could be considered if a long-term growth outlook is anticipated, while accepting the associated risks.

- For Risk-Averse Investors: A "sell" or avoid strategy might be preferred depending on individual risk tolerance.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Understanding investment risk is paramount. The stock market is inherently volatile, and investment outcomes are never guaranteed.

Conclusion: Making Informed Decisions with the PFG Stock Assessment

This assessment of the 13 analyst ratings provides valuable insights into the current market sentiment surrounding Principal Financial Group (PFG) stock. It highlights the importance of considering multiple factors—financial performance, macroeconomic conditions, competitive landscape, and regulatory environment—when evaluating PFG stock. Remember, this analysis is a starting point. Conducting your own thorough due diligence, including examining PFG stock performance history and the latest financial reports, is crucial before making any investment decision regarding PFG stock. Use this information to inform your own investment strategy for Principal Financial Group (PFG) stock, but remember that this article is not financial advice. Always consult with a qualified financial professional before making investment decisions.

Featured Posts

-

No Kyc Casinos 2025 7 Bit Casino Review Instant Withdrawals And Security

May 17, 2025

No Kyc Casinos 2025 7 Bit Casino Review Instant Withdrawals And Security

May 17, 2025 -

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025

Game 4 Pistons Anger Over Questionable Referee Decision

May 17, 2025 -

Knicks Brunson Addresses Thibodeaus Uncertain Future

May 17, 2025

Knicks Brunson Addresses Thibodeaus Uncertain Future

May 17, 2025 -

Greenko Founders Explore New Deal To Acquire Orix Stake In India

May 17, 2025

Greenko Founders Explore New Deal To Acquire Orix Stake In India

May 17, 2025 -

Effektivnoe Upravlenie Biznesom V Konkurentnoy Srede Industrialnykh Parkov

May 17, 2025

Effektivnoe Upravlenie Biznesom V Konkurentnoy Srede Industrialnykh Parkov

May 17, 2025

Latest Posts

-

Discover Alan Carr And Amanda Holdens Exquisite Spanish Townhouse E245 K

May 17, 2025

Discover Alan Carr And Amanda Holdens Exquisite Spanish Townhouse E245 K

May 17, 2025 -

Luxury Spanish Townhouse For Sale E245 000 Designed By Carr And Holden

May 17, 2025

Luxury Spanish Townhouse For Sale E245 000 Designed By Carr And Holden

May 17, 2025 -

Spanish Property For Sale E245 K Townhouse Renovated By Alan Carr And Amanda Holden

May 17, 2025

Spanish Property For Sale E245 K Townhouse Renovated By Alan Carr And Amanda Holden

May 17, 2025 -

Alan Carr And Amanda Holdens Stunning Spanish Townhouse Now On The Market For E245 K

May 17, 2025

Alan Carr And Amanda Holdens Stunning Spanish Townhouse Now On The Market For E245 K

May 17, 2025 -

No Doctor Who Christmas Special In 2024

May 17, 2025

No Doctor Who Christmas Special In 2024

May 17, 2025