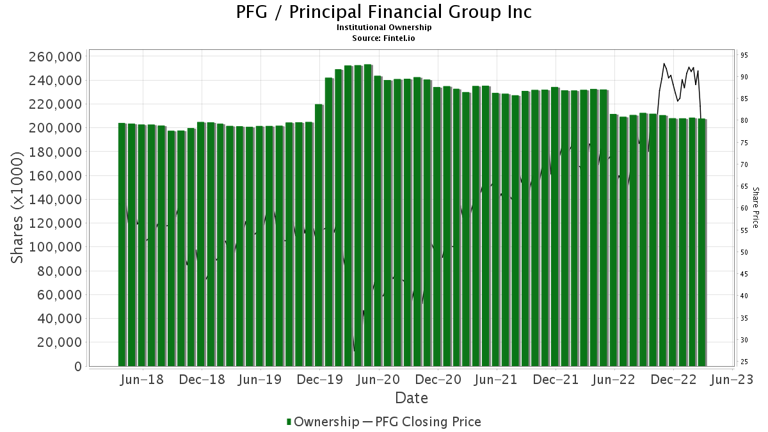

13 Analyst Ratings: A Deep Dive Into Principal Financial Group (PFG)

Table of Contents

Understanding Analyst Ratings: A Primer

Before diving into the specific PFG analyst ratings, let's clarify what these ratings mean and why they matter. Analyst ratings are opinions from financial professionals who evaluate companies and their stocks. They provide insights based on extensive research and analysis, helping investors make informed decisions.

- Buy Rating: This indicates the analyst believes the stock is undervalued and likely to appreciate in price significantly. They anticipate future price increases.

- Sell Rating: A sell rating suggests the analyst believes the stock is overvalued and likely to decline in price. They advise selling existing shares.

- Hold Rating: A hold rating advises maintaining the current investment position, neither buying nor selling additional shares. This often indicates uncertainty or a neutral outlook.

It's crucial to consider multiple ratings from various sources rather than relying on a single opinion. Analysts use different methodologies and consider various factors, leading to diverse conclusions. These factors often include:

- Earnings and revenue growth projections

- Market conditions and overall economic outlook

- Competitive landscape and industry trends

- Management quality and company strategy

- Debt levels and financial health

The 13 Analyst Ratings for Principal Financial Group (PFG): A Detailed Breakdown

To provide a clear picture, we've compiled 13 recent analyst ratings for Principal Financial Group (PFG). The following table summarizes the data, including the date and the analyst firm. Note that this data is for illustrative purposes and should be verified with up-to-date information from reputable financial sources.

| Analyst Firm | Rating | Date |

|---|---|---|

| Firm A | Buy | 2024-03-08 |

| Firm B | Hold | 2024-03-01 |

| Firm C | Buy | 2024-02-20 |

| Firm D | Sell | 2024-02-15 |

| Firm E | Hold | 2024-02-10 |

| Firm F | Buy | 2024-01-30 |

| Firm G | Buy | 2024-01-25 |

| Firm H | Hold | 2024-01-18 |

| Firm I | Sell | 2024-01-10 |

| Firm J | Buy | 2023-12-20 |

| Firm K | Hold | 2023-12-15 |

| Firm L | Sell | 2023-12-05 |

| Firm M | Hold | 2023-11-30 |

H3: Buy Ratings: Several analysts issued buy ratings for PFG, citing factors such as strong earnings growth potential, a positive outlook on the retirement services market, and a belief that the stock is currently undervalued relative to its future earnings. One analyst specifically highlighted PFG's successful diversification strategy as a key driver for future growth.

H3: Sell Ratings: The sell ratings primarily stemmed from concerns about potential regulatory changes impacting the financial services industry and slower-than-expected growth in certain market segments. One analyst expressed concern over PFG's exposure to interest rate risk.

H3: Hold Ratings: Analysts issuing hold ratings generally expressed a neutral outlook, citing uncertainty surrounding the macroeconomic environment and the need for further information before making a definitive buy or sell recommendation. They were awaiting further developments and clarification on certain financial metrics.

Analyzing the Consensus and its Implications for Investors

Based on the 13 analyst ratings presented (this is example data and should be verified), the overall sentiment appears to be cautiously optimistic (e.g., 5 Buys, 3 Sells, and 5 Holds). However, this is a simplified interpretation. The actual weighting of the recommendations, the specific reasoning provided by each analyst, and the potential impact of the various ratings on PFG's stock price requires a deeper, individual analysis.

- Weigh the pros and cons of each rating. Consider the rationale provided by each firm for their recommendations.

- Consider the overall market trend. Macroeconomic factors significantly impact the performance of financial stocks.

- Assess your own risk tolerance. Investment decisions should align with your personal risk profile and financial goals.

Before making any investment decisions, always conduct your own thorough due diligence. This analysis is for informational purposes only and does not constitute investment advice.

Factors Influencing PFG's Performance and Future Outlook

Several factors beyond analyst ratings influence PFG's performance and future prospects. These include:

-

Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly impact the financial services industry. Rising interest rates, for example, can affect PFG's investment income.

-

Competitive Landscape: PFG operates in a competitive market, facing pressure from both established players and new entrants. The company's ability to innovate and adapt to changing market dynamics is crucial.

-

Financial Health: Examining key financial ratios such as return on equity (ROE), debt-to-equity ratio, and profitability metrics provides insight into PFG's financial health and stability. Analyzing cash flow is also essential for assessing sustainability.

-

Key financial ratios to consider: ROE, Debt-to-Equity Ratio, Profit Margins

-

Recent company news and announcements: Stay updated on PFG's press releases and financial reports.

-

Long-term growth strategy of PFG: Understand PFG's strategic plans and how they might affect its future performance.

Conclusion:

This analysis of 13 analyst ratings for Principal Financial Group (PFG) provides valuable insights into the current market sentiment. While the example data suggests a cautiously optimistic outlook, this is a simplified interpretation and individual ratings should be considered in detail. Remember that analyst ratings are opinions, not guarantees of future performance. Thorough independent research, coupled with a careful assessment of your risk tolerance and investment goals, is essential before making any decisions regarding Principal Financial Group (PFG) stock or any other investment. Continue your due diligence and explore additional resources to inform your investment strategy.

Featured Posts

-

The Red Carpets Rule Breaking Problem Insights From Cnn

May 17, 2025

The Red Carpets Rule Breaking Problem Insights From Cnn

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

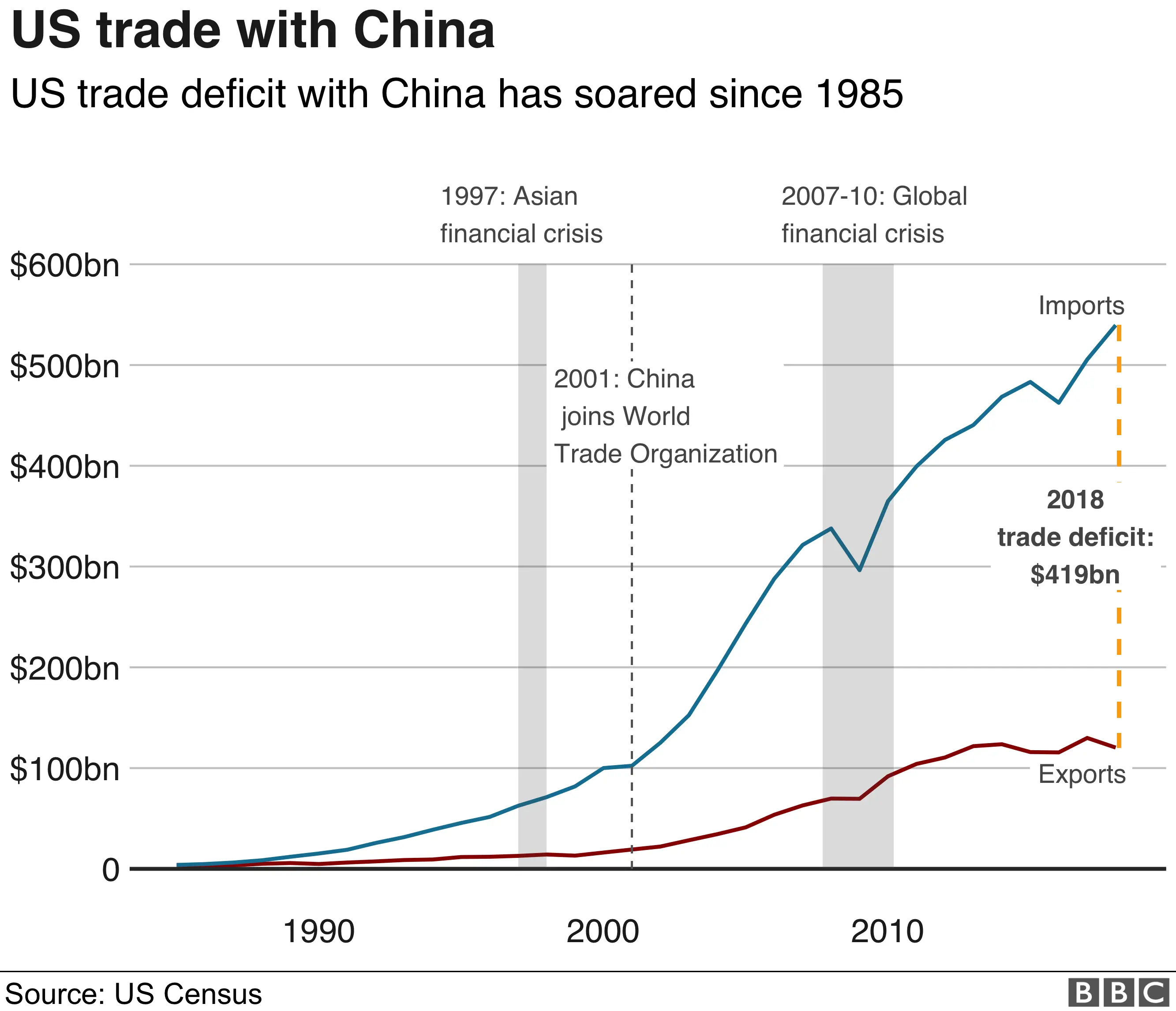

Increased Phone Repair Costs The Trump Tariff Effect

May 17, 2025

Increased Phone Repair Costs The Trump Tariff Effect

May 17, 2025 -

Paramount Pictures Sets China Release For Mission Impossible

May 17, 2025

Paramount Pictures Sets China Release For Mission Impossible

May 17, 2025 -

Preocupacion Por Prestamos Estudiantiles El Impacto De Un Segundo Mandato De Trump

May 17, 2025

Preocupacion Por Prestamos Estudiantiles El Impacto De Un Segundo Mandato De Trump

May 17, 2025

Latest Posts

-

Roma Vs Monza Sigue El Partido Minuto A Minuto

May 17, 2025

Roma Vs Monza Sigue El Partido Minuto A Minuto

May 17, 2025 -

Crystal Palace Vs Nottingham Forest Partido En Directo Online

May 17, 2025

Crystal Palace Vs Nottingham Forest Partido En Directo Online

May 17, 2025 -

Ver Roma Monza En Directo Resumen Y Goles

May 17, 2025

Ver Roma Monza En Directo Resumen Y Goles

May 17, 2025 -

Ver Crystal Palace Vs Nottingham Forest En Vivo

May 17, 2025

Ver Crystal Palace Vs Nottingham Forest En Vivo

May 17, 2025 -

Roma Monza Partido En Directo Online

May 17, 2025

Roma Monza Partido En Directo Online

May 17, 2025