10x Bitcoin Multiplier: A Chart Of The Week Analysis

Table of Contents

Understanding the Potential for a 10x Bitcoin Multiplier

Bitcoin's history is punctuated by periods of explosive growth. To understand the potential for a 10x Bitcoin multiplier, we must examine past performance. Remember, past performance is not indicative of future results. However, analyzing previous surges provides valuable context.

Factors contributing to significant Bitcoin price increases include:

- Increased adoption: Wider acceptance by businesses, institutions, and individuals fuels demand and drives price appreciation.

- Institutional investment: Large-scale investments from corporations and hedge funds inject significant capital into the market.

- Regulatory changes: Positive regulatory developments, such as ETF approvals, can boost investor confidence and liquidity.

However, predicting such substantial returns is inherently risky. A 10x Bitcoin multiplier is not guaranteed, and significant losses are possible.

- Examples of past Bitcoin price surges:

- The 2017 bull run, driven by increasing mainstream awareness and speculation.

- The 2021 bull run, fueled by institutional investment and the growing acceptance of Bitcoin as a store of value.

- Potential future catalysts for a similar price increase:

- Widespread adoption by major corporations as a payment method.

- Approval of Bitcoin ETFs in major global markets.

- Continued institutional investment and the growth of Bitcoin-related financial products.

- Importance of diversification and responsible investing: Never invest more than you can afford to lose. Diversify your portfolio across different asset classes to mitigate risk.

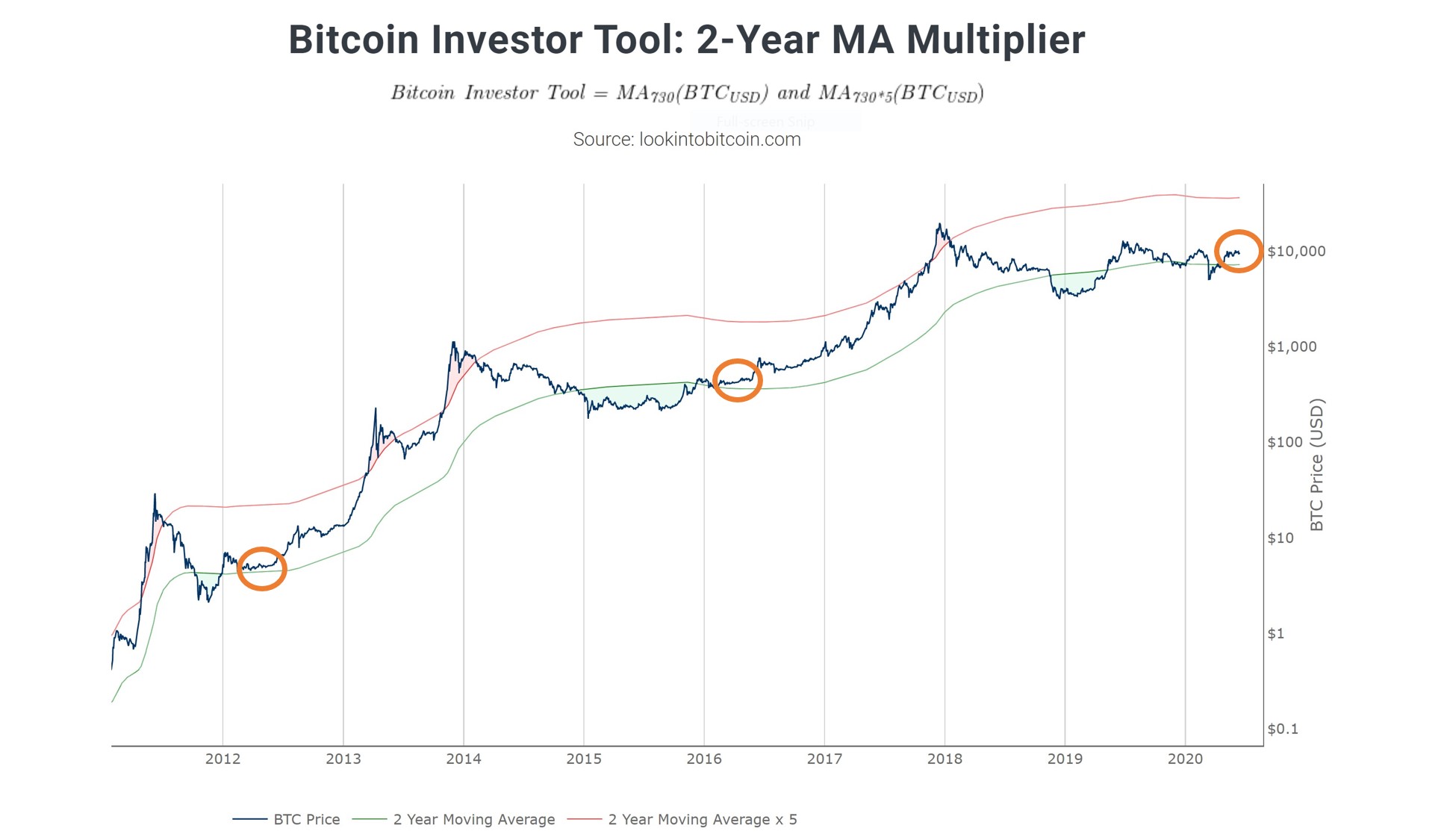

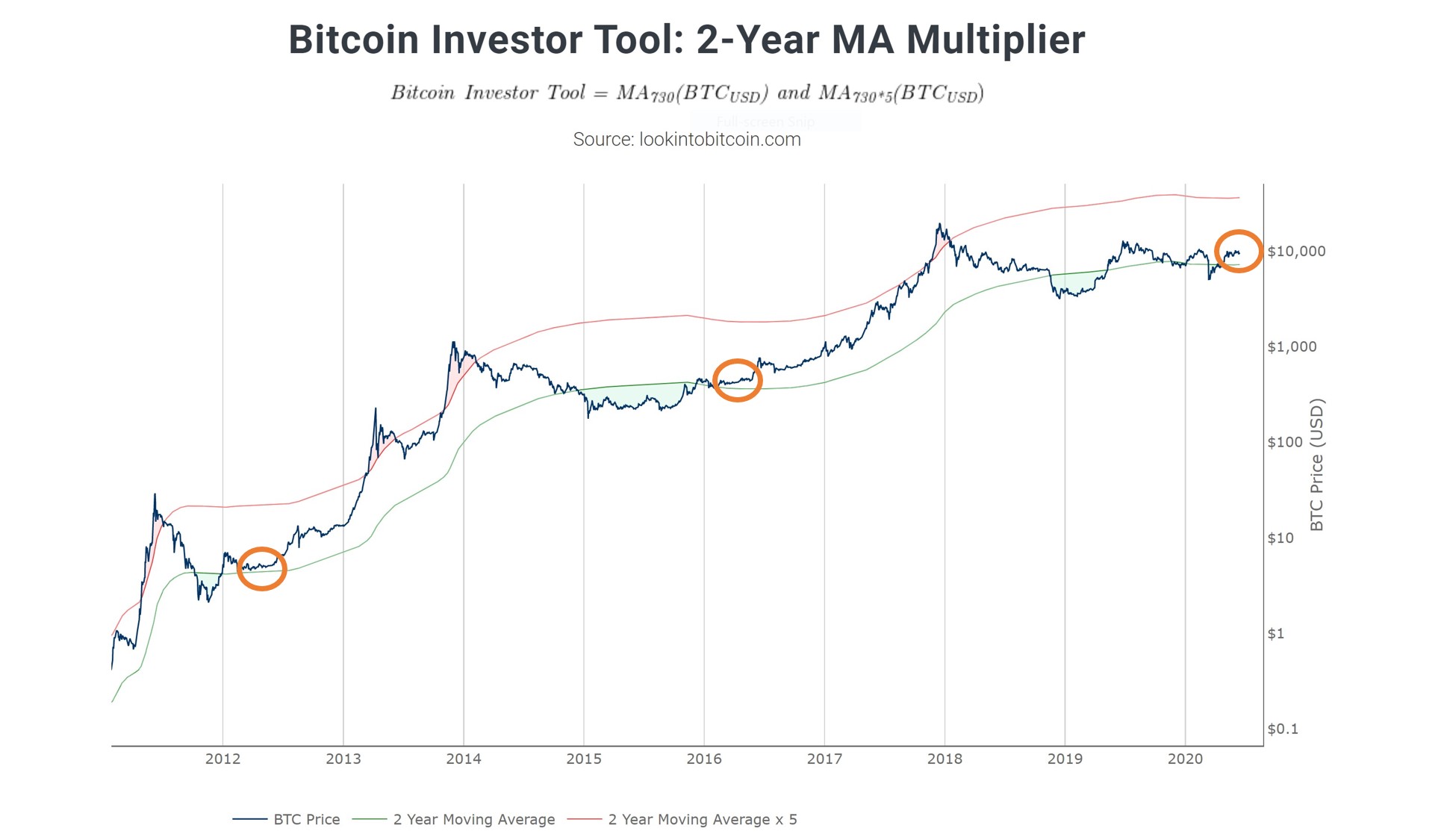

Technical Analysis: Deciphering the Charts

Analyzing Bitcoin's price charts using technical indicators is crucial for identifying potential trends. We will focus on weekly and monthly charts to gain a long-term perspective.

Key indicators supporting a potential 10x multiplier might include:

- Moving averages: A bullish crossover of long-term and short-term moving averages could signal an upward trend.

- RSI (Relative Strength Index): Readings below 30 could suggest the market is oversold, potentially indicating a bounce.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover could confirm an upward trend.

Chart patterns also offer valuable insights:

-

Head and shoulders: A bullish head and shoulders pattern could signal a significant price increase.

-

Cup and handle: This pattern suggests a period of consolidation followed by a breakout, potentially leading to substantial gains.

-

Bullish flags: These patterns signal temporary pauses in an upward trend before a continuation of the rally.

-

Specific chart examples: (Include actual chart images here with annotations pointing out key indicators and patterns.)

-

Indicator significance: (Explain each indicator's role in the analysis, linking it to the potential for a 10x Bitcoin multiplier.)

-

Visual aids: (Use clear and well-labeled charts and graphs to enhance understanding.)

Market Sentiment and Adoption: Gauging the Overall Climate

Gauging market sentiment is vital for assessing the likelihood of a 10x Bitcoin multiplier. Factors to consider include:

- Social media sentiment: Analyzing social media trends can provide insights into public opinion and market psychology. Positive sentiment often precedes price increases.

- News coverage: Favorable news coverage regarding Bitcoin's adoption, regulatory developments, or technological advancements can boost investor confidence.

- Institutional adoption: Increasing acceptance by institutional investors signals growing legitimacy and potential for sustained price growth.

Potential catalysts for accelerated price growth include:

-

ETF approval: Regulatory approval of Bitcoin exchange-traded funds (ETFs) could significantly increase liquidity and accessibility, potentially driving a price surge.

-

Widespread business adoption: Increased adoption by businesses as a payment method could boost demand and drive price appreciation.

-

Examples of positive and negative news: (Provide examples of news headlines and their impact on Bitcoin's price.)

-

Social media trend analysis: (Discuss correlations between social media sentiment and price movements.)

-

Regulatory impact: (Analyze the potential effects of regulatory hurdles or supportive regulations.)

Risk Management and Responsible Investing in a 10x Bitcoin Multiplier Scenario

Investing in Bitcoin involves significant risk. A 10x Bitcoin multiplier scenario is highly speculative, and significant losses are possible. Effective risk management is paramount.

Key strategies include:

- Diversification: Spread your investments across different asset classes to reduce the impact of potential losses in one area.

- Stop-loss orders: Set stop-loss orders to automatically sell your Bitcoin if the price falls below a predetermined level, limiting potential losses.

- Position sizing: Avoid investing too much of your capital in a single asset, especially a volatile one like Bitcoin.

Responsible investing practices also include:

-

Thorough research: Conduct thorough due diligence before investing in any asset, especially high-risk assets like Bitcoin.

-

Avoid impulsive decisions: Avoid making impulsive investment decisions based on emotions or hype.

-

Seek professional advice: Consider consulting a financial advisor before making significant investments in cryptocurrency.

-

Risk management techniques: (Explain different techniques with clear examples.)

-

Implementation in Bitcoin trading: (Show how to implement these strategies in a practical Bitcoin trading plan.)

-

Warning against emotional trading: (Stress the importance of rational decision-making and avoiding emotional responses to market fluctuations.)

Conclusion: Navigating the Path to a Potential 10x Bitcoin Multiplier

This analysis explored the possibility of a 10x Bitcoin multiplier, examining technical indicators, market sentiment, and potential catalysts. While a tenfold increase is certainly possible given Bitcoin's historical volatility, it's crucial to remember the inherent risks involved. Thorough research, robust risk management strategies, and responsible investing are essential for navigating this volatile market. Conduct your own independent research, use the insights provided to inform your decisions, and carefully monitor the Bitcoin market for further developments. Stay informed and continue your journey to understanding the potential of a 10x Bitcoin multiplier.

Featured Posts

-

Wall Streets Next Big Thing Bitcoins Potential 10x Multiplier

May 08, 2025

Wall Streets Next Big Thing Bitcoins Potential 10x Multiplier

May 08, 2025 -

Economic Overhaul Urged Amidst Taiwan Dollars Appreciation

May 08, 2025

Economic Overhaul Urged Amidst Taiwan Dollars Appreciation

May 08, 2025 -

Will Xrp Hit 5 In 2025 Analyzing The Potential

May 08, 2025

Will Xrp Hit 5 In 2025 Analyzing The Potential

May 08, 2025 -

Jayson Tatums Continued Scrutiny Colin Cowherds Persistent Criticism Explained

May 08, 2025

Jayson Tatums Continued Scrutiny Colin Cowherds Persistent Criticism Explained

May 08, 2025 -

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025