10-Year Mortgages In Canada: A Look At Consumer Trends

Table of Contents

The Appeal of 10-Year Mortgages in Canada

The rising adoption of 10-year mortgages reflects a shift in Canadian consumer priorities. Longer-term mortgages offer several key benefits that are particularly attractive in today's economic climate.

Predictability and Stability

Long-term fixed rates provide unparalleled peace of mind, especially during periods of economic uncertainty. Locking in your interest rate for a decade eliminates the stress of fluctuating rates and allows for more precise long-term financial planning.

- Reduced stress from fluctuating interest rates: Avoid the anxiety of potential rate hikes during your mortgage term.

- Predictable monthly payments: Budget with confidence knowing your mortgage payment will remain consistent for 10 years.

- Long-term financial planning: Easily integrate your fixed mortgage payment into your long-term financial goals, such as retirement planning or investment strategies.

While precise data on the percentage of Canadians choosing longer-term mortgages is not readily available in a centralized public database, anecdotal evidence from mortgage brokers and financial institutions suggests a noticeable increase in 10-year mortgage applications in recent years.

Potential for Lower Interest Rates

While a 10-year mortgage may initially come with a slightly higher interest rate compared to a shorter-term option, the potential for lower overall interest costs over the life of the loan is a significant draw.

- Comparison of average rates for 5-year vs. 10-year mortgages: While specific rates vary by lender and borrower profile, a comparison of historical data often shows that the average interest rate over a 10-year period can be lower than the cumulative cost of two consecutive 5-year mortgages, particularly if rates rise during the second 5-year term. (Note: Always consult current rate comparisons from reputable financial sources.)

- Importance of comparing offers from different lenders: Shop around and compare rates from multiple lenders to secure the best possible deal. Don't settle for the first offer you receive.

- Potential rate changes during the term: While the interest rate is fixed for the 10-year period, it is crucial to understand that refinancing options exist should significantly better rates become available later.

Challenges and Considerations of 10-Year Mortgages

While the advantages are compelling, it's crucial to acknowledge the potential drawbacks of a 10-year mortgage commitment.

Higher Initial Interest Rates

It's important to understand that 10-year mortgages typically carry a higher initial interest rate than shorter-term options. This is because lenders compensate for the increased risk associated with the longer loan term.

- Relationship between loan term and interest rate: Lenders generally charge higher interest rates for longer loan terms to account for the increased risk of fluctuating interest rates and economic uncertainty.

- Examples of rate differences: The difference in initial rates can vary depending on market conditions and lender policies, but expect a slightly elevated rate compared to a 5-year mortgage.

Prepayment Penalties

A significant factor to consider is the prepayment penalty associated with breaking a 10-year mortgage early. These penalties can be substantial, making it crucial to carefully evaluate your financial flexibility before committing.

- Outline of different penalty structures: Penalties can vary widely depending on the lender and the specifics of your mortgage agreement. They may include interest rate differentials or a percentage of the outstanding principal.

- Importance of carefully considering your financial flexibility: Ensure you have a stable financial situation and are confident in your ability to make payments for the entire 10-year term.

Market Volatility and Long-Term Predictions

Predicting market conditions over a decade is inherently challenging. Economic downturns, interest rate fluctuations, and unforeseen circumstances can impact your financial stability over such a long term.

- Potential risks associated with long-term commitment: Understand that your financial situation can change significantly over 10 years, and this long-term commitment necessitates careful planning and consideration of potential risks.

Consumer Trends Shaping 10-Year Mortgage Choices

Several key trends are driving the increased popularity of 10-year mortgages among Canadian consumers.

Growing Homeownership Aspirations

Rising home prices and tighter lending conditions are making homeownership more challenging. A 10-year mortgage can provide a pathway to homeownership for some by potentially offering a more manageable monthly payment over the long term.

- Impact of rising home prices and tighter lending conditions: These factors make longer-term mortgages an attractive option for some buyers who may not qualify for shorter-term loans.

- Data on homeownership rates in Canada: While homeownership rates fluctuate, the desire for homeownership remains a significant driving force behind mortgage choices.

Increased Financial Literacy and Planning

Canadians are becoming more financially savvy, leading to more informed mortgage decisions. This includes a greater understanding of long-term financial planning and the benefits of fixed-rate mortgages.

- Role of financial advisors in assisting with mortgage selection: Financial advisors play a key role in guiding clients toward the most suitable mortgage options based on their individual financial situations and long-term goals.

Shifting Demographics and Life Stages

Changing demographics are influencing mortgage preferences. Millennials, for example, often prioritize financial stability and long-term planning, making longer-term mortgages an appealing option.

- Impact of millennial homebuyers and their preferences: This generation's approach to finances and risk tolerance is shaping mortgage trends.

Finding the Right 10-Year Mortgage in Canada

Securing the best 10-year mortgage requires diligent research and careful planning.

Shopping Around and Comparing Rates

Don't settle for the first offer you receive. Compare rates and terms from multiple lenders to secure the most favorable deal.

- Suggest using online mortgage comparison tools: Numerous online tools simplify the comparison process.

- Highlight the need for careful review of mortgage agreements: Thoroughly review all terms and conditions before signing any mortgage agreement.

Understanding Your Financial Situation

A realistic assessment of your personal finances is essential. Consider factors such as your debt-to-income ratio, credit score, and potential changes in your income.

- Consider factors like debt-to-income ratio, credit score, and potential changes in income: These factors will significantly influence your eligibility for a 10-year mortgage and the interest rate you'll receive.

Conclusion

10-year mortgages in Canada present both significant advantages and potential drawbacks. While the predictability of fixed rates and the potential for lower overall interest costs are attractive, the higher initial interest rates and prepayment penalties demand careful consideration. The increasing popularity of these mortgages reflects evolving consumer priorities, including a growing emphasis on long-term financial planning and stability. Are you considering a long-term financial commitment? Explore the benefits of a 10-year mortgage in Canada. Contact a mortgage broker or financial advisor today to discuss your options and find the best 10-year mortgage solution for your needs. Understanding the nuances of long-term mortgage options will empower you to make the best decision for your future.

Featured Posts

-

Examining The Reported Conflict Between Blake Lively And Anna Kendrick

May 05, 2025

Examining The Reported Conflict Between Blake Lively And Anna Kendrick

May 05, 2025 -

Breaking The China Grip The Promise Of Advanced Electric Motors

May 05, 2025

Breaking The China Grip The Promise Of Advanced Electric Motors

May 05, 2025 -

Analyzing Ufc 314 Early Betting Odds And Potential Upsets

May 05, 2025

Analyzing Ufc 314 Early Betting Odds And Potential Upsets

May 05, 2025 -

From Pitch Perfect To Real Life Friends Anna Kendrick And Rebel Wilsons Story

May 05, 2025

From Pitch Perfect To Real Life Friends Anna Kendrick And Rebel Wilsons Story

May 05, 2025 -

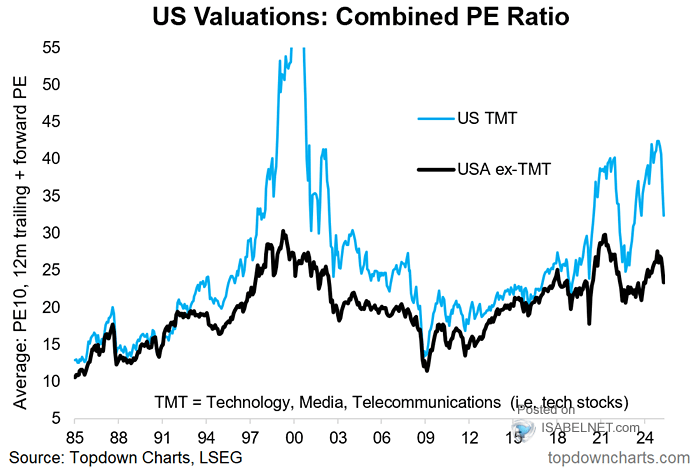

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 05, 2025

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 05, 2025

Latest Posts

-

Tragedy Strikes Raiwaqa Woman Dies In House Fire

May 05, 2025

Tragedy Strikes Raiwaqa Woman Dies In House Fire

May 05, 2025 -

Fatal Raiwaqa Fire Woman Perishes In Flames

May 05, 2025

Fatal Raiwaqa Fire Woman Perishes In Flames

May 05, 2025 -

Chicago Med Season 10 Brian Tees Return In Episode 14

May 05, 2025

Chicago Med Season 10 Brian Tees Return In Episode 14

May 05, 2025 -

Torture And Murder Of 16 Year Old Mother Charged With Neglect

May 05, 2025

Torture And Murder Of 16 Year Old Mother Charged With Neglect

May 05, 2025 -

Police Collaboration Leads To Life Sentence For Child Sex Offender

May 05, 2025

Police Collaboration Leads To Life Sentence For Child Sex Offender

May 05, 2025