10-Year Mortgages In Canada: A Look At Consumer Preferences

Table of Contents

The Appeal of 10-Year Mortgages in Canada

Canadians are increasingly choosing 10-year mortgage terms for several compelling reasons. The stability and predictability offered by a fixed-rate mortgage over a decade are highly attractive in today's uncertain economic climate.

- Predictability of payments and long-term financial planning: Knowing your exact mortgage payment for ten years allows for meticulous budgeting and long-term financial planning. This is crucial for managing other expenses and achieving significant financial goals, such as saving for retirement or children's education.

- Potential for lower interest rates: While not guaranteed, longer-term mortgages can sometimes offer lower interest rates compared to shorter-term options like 5-year mortgages, depending on prevailing market conditions. This potential for savings over the life of the mortgage is a significant incentive.

- Peace of mind from fixed payments for a decade: The security of a fixed payment for ten years eliminates the anxiety associated with fluctuating interest rates and potential payment increases that come with shorter-term mortgages. This predictability is invaluable for many homeowners.

- Opportunities for accelerated mortgage repayment strategies: A 10-year mortgage provides a longer timeframe to implement aggressive repayment strategies, such as making bi-weekly payments or lump-sum prepayments, potentially saving thousands of dollars in interest over the life of the loan.

While precise statistics on the growth of 10-year mortgages are not readily available in a centralized public database, anecdotal evidence from mortgage brokers and lenders suggests a noticeable increase in consumer interest in longer-term options.

Disadvantages and Considerations of 10-Year Mortgages

While the appeal of a 10-year mortgage is undeniable, it's essential to acknowledge potential drawbacks. Committing to a decade-long mortgage requires careful consideration.

- Risk of higher interest rates: If interest rates rise significantly during the 10-year period, you'll be locked into a potentially higher rate for the entire term. This could make your monthly payments more burdensome than anticipated.

- Limited flexibility – penalties for breaking the mortgage early: Breaking a 10-year mortgage before the term expires usually incurs substantial penalties. Life changes, such as job loss or relocation, could create significant financial hardship if you need to sell your home early.

- Need for a stable financial situation: Consistent payments for ten years require a stable income and financial situation. Unforeseen circumstances could jeopardize your ability to maintain payments, leading to serious financial repercussions.

- Potential for changes in personal circumstances: Life is unpredictable. A job loss, illness, or unexpected family emergency could impact your ability to consistently meet your mortgage obligations over such a long period.

Prepayment options exist, but they often have limitations. Understanding the specifics of prepayment clauses and penalties within your mortgage agreement is critical before signing.

Consumer Preferences: Who Benefits Most from a 10-Year Mortgage?

A 10-year mortgage is not a one-size-fits-all solution. It's best suited for specific homeowner profiles.

- Homeowners with stable income and long-term financial goals: Individuals with stable, predictable income and a long-term vision for their homeownership are ideal candidates.

- Individuals planning to stay in their home for at least 10 years: The benefits of a 10-year mortgage are maximized if you intend to remain in your home for the entire term.

- Those comfortable with less flexibility in their mortgage: The lack of flexibility and potential penalties for early breakage mean that those comfortable with a less adaptable mortgage are better suited for this option.

- Buyers seeking long-term predictability and financial stability: If peace of mind from consistent payments is a priority, a 10-year mortgage offers significant advantages.

Conversely, those anticipating potential life changes, job instability, or those prioritizing maximum flexibility should carefully consider shorter-term options.

Comparing 10-Year Mortgages to Shorter-Term Options

Comparing a 10-year mortgage to a shorter-term option, such as a 5-year mortgage, requires considering several factors.

- Interest rate fluctuations: Shorter-term mortgages offer more flexibility to adjust to fluctuating interest rates at renewal, while 10-year mortgages lock you in.

- Flexibility and renewal options: 5-year mortgages offer more frequent opportunities to renegotiate terms and potentially secure a lower interest rate.

- Total interest paid: While a lower initial interest rate might be secured with a 10-year mortgage, the total interest paid over the life of the loan could be higher than a shorter-term option if rates decrease significantly during the renewal period.

- Long-term financial implications: Careful consideration of your long-term financial projections, income stability, and potential life changes is crucial in choosing the right mortgage term.

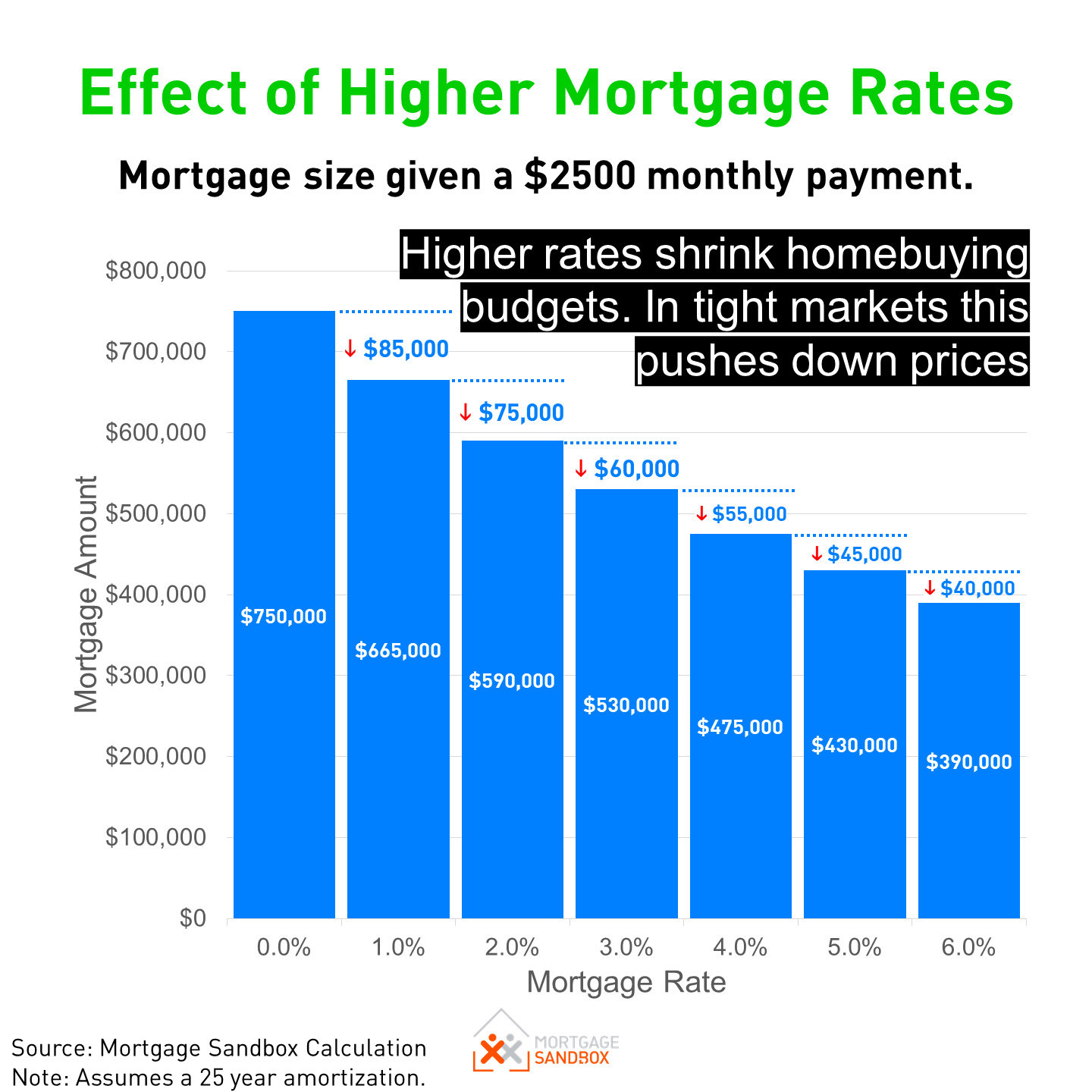

A visual comparison using charts could effectively illustrate the differences in interest paid and monthly payments over time for various mortgage terms.

Finding the Best 10-Year Mortgage in Canada

Securing the best 10-year mortgage requires a proactive approach.

- Comparing rates and terms from different lenders: Don't settle for the first offer you receive. Shop around and compare rates and terms from various banks and mortgage lenders.

- Factors to consider when choosing a mortgage: Pay close attention to prepayment options, penalties for early breakage, and any additional fees.

- Seeking advice from a mortgage broker: A mortgage broker can help navigate the complexities of the mortgage market and find the best options to suit your individual needs.

- Understanding mortgage insurance requirements: Depending on your down payment, you may require mortgage insurance, which can add to your overall costs.

Careful research and planning are essential to finding the most suitable 10-year mortgage for your circumstances.

Conclusion: Making Informed Decisions about 10-Year Mortgages in Canada

Ten-year mortgages in Canada offer significant advantages in terms of financial predictability and potential long-term savings. However, the reduced flexibility and potential exposure to higher interest rates must be carefully weighed against these benefits. Assessing your personal financial situation, long-term goals, and comfort level with risk is paramount before committing to a 10-year mortgage. Thorough research, comparison shopping, and seeking professional advice will help you secure the right 10-year mortgage in Canada for your financial future! Start comparing Canadian 10-year mortgage rates today!

Featured Posts

-

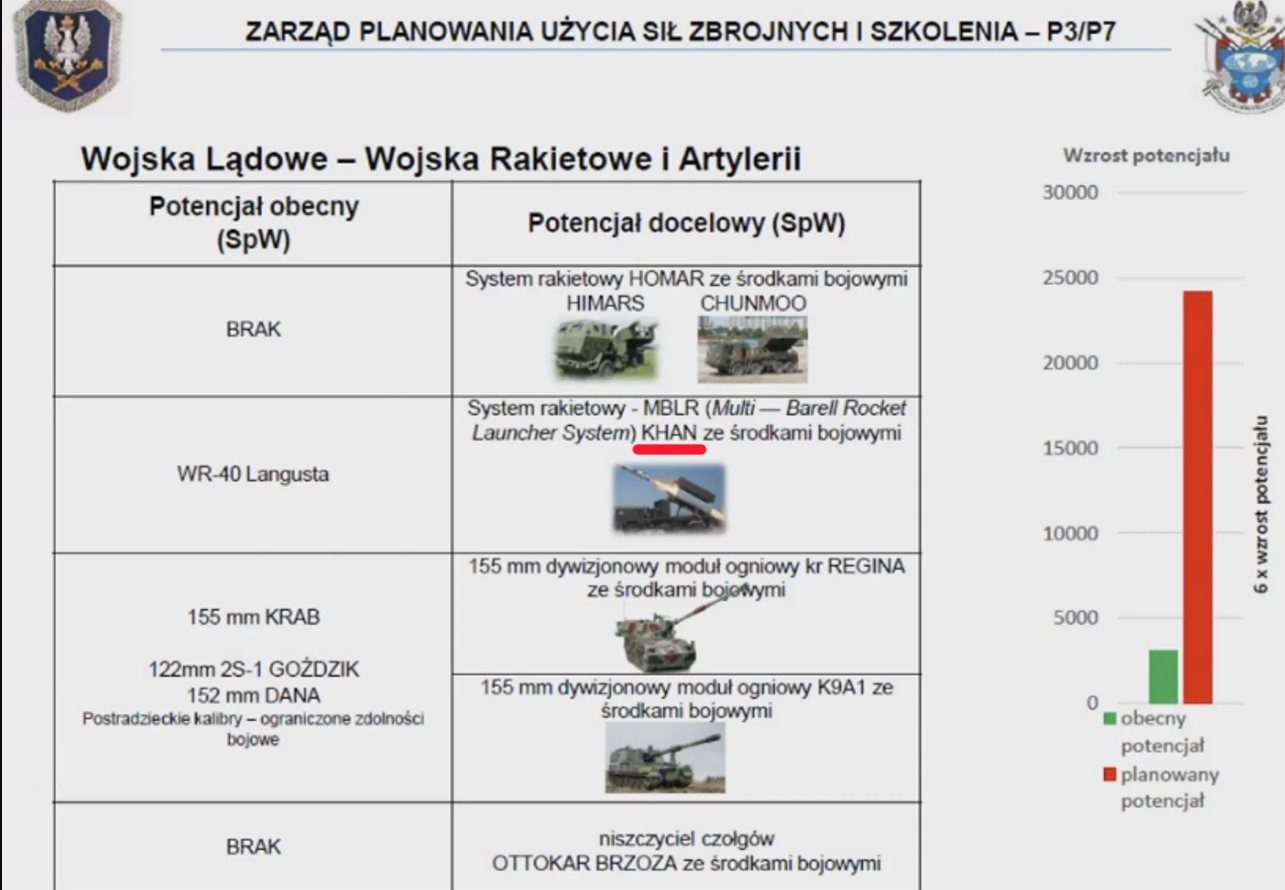

Trotyl Z Polski Dla Armii Amerykanskiej Szczegoly Kontraktu

May 06, 2025

Trotyl Z Polski Dla Armii Amerykanskiej Szczegoly Kontraktu

May 06, 2025 -

Strategiczne Partnerstwo Nitro Chem I Dostawy Trotylu Dla Sil Zbrojnych Usa

May 06, 2025

Strategiczne Partnerstwo Nitro Chem I Dostawy Trotylu Dla Sil Zbrojnych Usa

May 06, 2025 -

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025

Celtics Vs 76ers Prediction Expert Picks Odds And Best Bets Feb 20 2025

May 06, 2025 -

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

May 06, 2025

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

May 06, 2025 -

I Need To Talk About Mindy Kalings Fascinating Female Characters

May 06, 2025

I Need To Talk About Mindy Kalings Fascinating Female Characters

May 06, 2025

Latest Posts

-

Diana Ross Symphonic Celebration 2025 Uk Tour Tickets On Sale Now

May 06, 2025

Diana Ross Symphonic Celebration 2025 Uk Tour Tickets On Sale Now

May 06, 2025 -

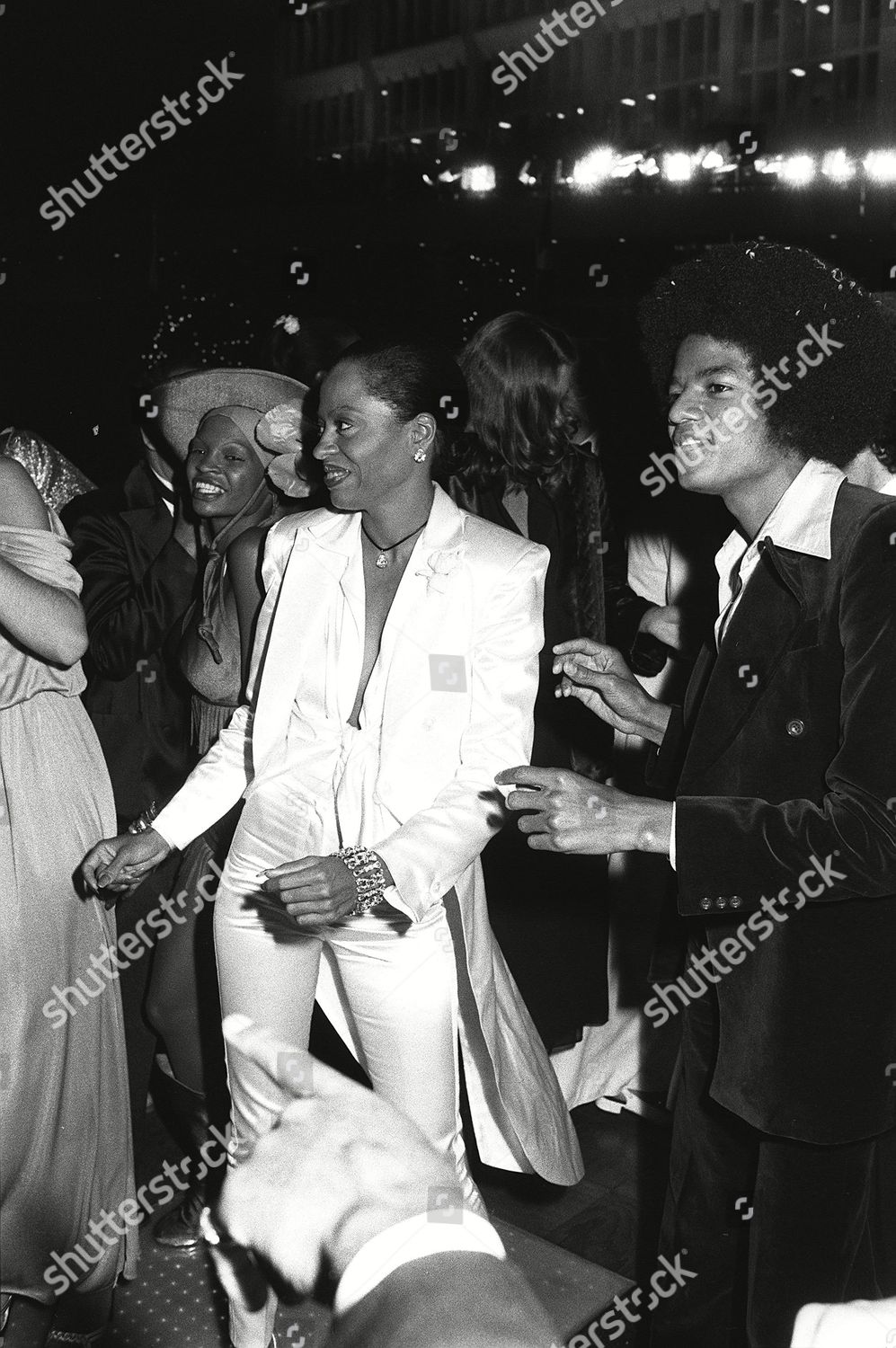

Diana Rosss Promise To Michael Jackson Revealed

May 06, 2025

Diana Rosss Promise To Michael Jackson Revealed

May 06, 2025 -

Diana Ross Symphonic Celebration 2025 Uk Tour Dates Venues And Ticket Information

May 06, 2025

Diana Ross Symphonic Celebration 2025 Uk Tour Dates Venues And Ticket Information

May 06, 2025 -

Tracee Ellis Rosss Runway Return 30 Years Later With Marni

May 06, 2025

Tracee Ellis Rosss Runway Return 30 Years Later With Marni

May 06, 2025 -

Exclusive Night Out Style Channel Nile Rodgers I M Coming Out Energy

May 06, 2025

Exclusive Night Out Style Channel Nile Rodgers I M Coming Out Energy

May 06, 2025