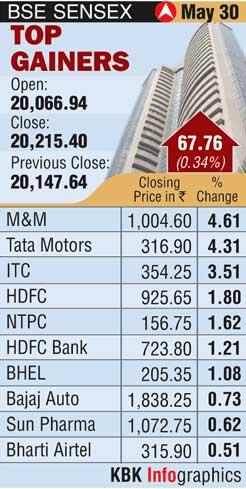

10%+ Gains On BSE: Sensex Up, Top Performing Stocks Identified

Table of Contents

Key Factors Contributing to the Sensex Rally

The recent Sensex surge isn't a random event; several key factors have converged to propel the market upward. Understanding these drivers is crucial for investors seeking to make informed decisions. The BSE Sensex gains are a result of a confluence of positive economic indicators and global market trends.

-

Stronger-than-expected Quarterly Earnings Reports: Many leading companies have announced better-than-anticipated quarterly results, exceeding market expectations and boosting investor confidence. This positive performance reflects the underlying strength of the Indian economy.

-

Positive Government Policies Boosting Investor Confidence: Government initiatives aimed at stimulating economic growth and improving the business environment have played a significant role. These policies have created a more favorable climate for investment and spurred market optimism.

-

Improved Global Economic Outlook: A relatively positive global economic outlook, despite ongoing challenges, has contributed to the inflow of foreign investment into the Indian stock market. This increased global confidence has positively impacted the BSE Sensex.

-

Foreign Institutional Investor (FII) Inflows: Significant inflows of funds from foreign institutional investors have provided substantial support to the Sensex rally. FIIs are increasingly optimistic about India's growth prospects.

Top Performing BSE Stocks: Sector-wise Analysis

The impressive BSE Sensex gains are largely driven by stellar performances across various sectors. Let's examine some of the top performers:

-

IT Sector: Companies like Infosys, TCS (Tata Consultancy Services), and HCL Technologies have been key contributors to the Sensex rally. Their strong Q[quarter] results, fueled by robust global demand for IT services, have significantly boosted their stock prices. These are some of the best performing stocks in this sector.

-

Banking Sector: HDFC Bank, ICICI Bank, and SBI (State Bank of India) have also showcased impressive growth. Increased lending activities and improved profitability have driven their stock prices higher, contributing to the overall Sensex gains. This sector showcases strong growth potential.

-

FMCG Sector: Hindustan Unilever and Nestle India, stalwarts of the FMCG sector, have demonstrated consistent performance driven by strong consumer demand. Their resilient performance reflects the stability of this sector even amidst market fluctuations.

Understanding the Risk and Volatility

While the current market sentiment is positive, it's crucial to acknowledge the inherent volatility of the stock market. The BSE Sensex, while showing significant gains, is not immune to corrections.

-

Market Corrections are Inevitable: Even during bull markets, temporary dips and corrections are normal. It's essential to be prepared for potential short-term fluctuations.

-

Individual Stock Performance Can Deviate from Overall Market Trends: While the Sensex might be rising, individual stocks can underperform or even decline. Thorough research is crucial before investing in any specific stock.

-

Diversification Minimizes Risk: Spreading investments across different sectors and asset classes is a fundamental risk management strategy. Diversification helps mitigate the impact of potential losses in any single sector.

-

Conduct Thorough Research Before Investing: Before investing in any BSE stock, conduct thorough due diligence, considering the company's financials, growth prospects, and overall market conditions.

Investment Strategies for Capitalizing on Future Gains

Capitalizing on the potential for future gains requires a well-defined investment strategy.

-

Research Companies Thoroughly Before Investing: Don't rely solely on market sentiment. Analyze a company's fundamentals, financial health, and future growth potential before investing.

-

Consider Your Risk Tolerance: Invest only an amount you can afford to lose. High-growth stocks generally come with higher risk.

-

Diversify Your Portfolio Across Sectors: Don't put all your eggs in one basket. Spread your investments across different sectors to reduce overall portfolio risk.

-

Invest for the Long Term: Short-term market fluctuations should not dictate your long-term investment strategy. Focus on companies with strong fundamentals and long-term growth potential.

Conclusion

The recent 10%+ surge in the BSE Sensex is a result of a combination of positive economic indicators, strong corporate earnings, and positive investor sentiment. Several sectors, notably IT, Banking, and FMCG, have driven these impressive BSE Sensex gains. However, it's crucial to remember that market volatility remains a factor. By understanding the key drivers of the rally, conducting thorough research, and employing sound investment strategies like diversification and long-term planning, investors can navigate this dynamic market and potentially capitalize on future growth opportunities. Stay updated on BSE Sensex movements and identify your next investment opportunities!

Featured Posts

-

Predicting The Giants Vs Padres Game Outright Padres Win Or Close Loss

May 15, 2025

Predicting The Giants Vs Padres Game Outright Padres Win Or Close Loss

May 15, 2025 -

Nhl Referees The Apple Watch Revolution On Ice

May 15, 2025

Nhl Referees The Apple Watch Revolution On Ice

May 15, 2025 -

Der Bvg Tarifstreit Ist Beendet So Sieht Die Einigung Aus

May 15, 2025

Der Bvg Tarifstreit Ist Beendet So Sieht Die Einigung Aus

May 15, 2025 -

Understanding The Gorklon Rust Name Change On Elon Musks X Platform

May 15, 2025

Understanding The Gorklon Rust Name Change On Elon Musks X Platform

May 15, 2025 -

Resultado Final Everton Vina 0 0 Coquimbo Unido

May 15, 2025

Resultado Final Everton Vina 0 0 Coquimbo Unido

May 15, 2025