$10.5 Million Fine For Resorts World Las Vegas Casino In Money Laundering Scandal

Table of Contents

The Allegations: How the Money Laundering Scheme Unfolded

The allegations against Resorts World Las Vegas center around a sophisticated money laundering scheme involving the processing of illicit funds through the casino's financial systems. The scheme allegedly exploited vulnerabilities in the casino's internal controls, allowing for the disguising and movement of illegal gambling proceeds. These activities represent serious violations of both state and federal anti-money laundering regulations and constitute a significant financial crime.

- Summary of the alleged scheme's mechanics: The specifics of the scheme remain partially undisclosed, pending ongoing investigations, but reports suggest the use of structured transactions (depositing smaller amounts of cash to avoid reporting thresholds) and potentially shell companies to obscure the origins of the funds.

- Involvement of specific individuals or entities: While the identities of individuals directly involved remain largely confidential, investigations are ongoing and may reveal further details in due course.

- The timeframe of the alleged activities: The period during which the alleged money laundering took place is currently under investigation. The investigation may reveal further details as it progresses.

- Types of transactions involved: The transactions under scrutiny reportedly included substantial cash deposits, wire transfers, and potentially the use of high-roller accounts to facilitate the movement of illicit funds. The full extent of these financial transactions is yet to be fully disclosed.

The Nevada Gaming Control Board's Investigation and Findings

The Nevada Gaming Control Board (NGCB), the state agency responsible for regulating the casino industry, launched a comprehensive investigation into the allegations against Resorts World Las Vegas. This investigation involved a meticulous examination of the casino’s financial records and operational procedures. The NGCB utilized various investigative methods, highlighting failures in the casino's compliance program.

- Timeline of the investigation: The investigation spanned several months, involving thorough audits of financial transactions and extensive interviews with employees and relevant stakeholders.

- Methods used in the investigation: The NGCB employed a multi-pronged approach, including forensic accounting, detailed analysis of transaction records, and interviews with casino personnel and potentially third-party individuals involved in the alleged scheme.

- Specific evidence presented by the NGCB: The NGCB presented compelling evidence indicating significant compliance failures with regard to AML regulations. Specific details of the evidence remain confidential pending ongoing investigations.

- Details of any cooperation from Resorts World Las Vegas: The extent of Resorts World Las Vegas' cooperation with the investigation is not entirely public. Further information will likely emerge as the legal proceedings continue.

Resorts World Las Vegas' Response and Subsequent Actions

In response to the allegations and the subsequent investigation, Resorts World Las Vegas released an official statement acknowledging the shortcomings in its AML compliance program and accepting responsibility for the violations. The casino has since pledged to implement significant changes to strengthen its internal controls and improve its anti-money laundering measures.

- Statement released by the casino: The statement expressed regret for the violations and reiterated the casino's commitment to strengthening its AML compliance program. Specific details of the statement remain publicly available via news outlets.

- Changes implemented in their AML procedures: These include enhanced transaction monitoring systems, improved staff training, and the implementation of more stringent due diligence procedures for high-roller clients.

- Staff training and education initiatives: The casino has invested heavily in retraining staff on AML compliance protocols and enhancing their ability to identify and report suspicious activities.

- Any penalties or consequences faced by employees involved: Details regarding any disciplinary action against employees are not public at this time.

Implications for the Casino Industry and Future Regulations

The Resorts World Las Vegas case serves as a stark reminder of the critical importance of robust AML compliance within the casino industry. This substantial fine underscores the severe consequences of failing to adhere to anti-money laundering regulations. This incident will likely trigger increased scrutiny of casino operations, stricter enforcement of existing regulations, and potentially even changes to regulatory frameworks to prevent similar incidents from occurring in the future.

- Increased awareness of AML compliance within the industry: The case has raised awareness among casino operators about the need for proactive and comprehensive AML compliance programs.

- Potential for stricter regulations and enforcement: Expect increased regulatory oversight and potentially harsher penalties for non-compliance with AML regulations.

- Impact on investor confidence in the casino industry: The scandal could negatively impact investor confidence, leading to increased scrutiny of casino investments.

- Lessons learned from the Resorts World Las Vegas case: The case highlights the need for continuous monitoring, improved staff training, and the use of advanced technology to detect and prevent money laundering activities.

Conclusion

The $10.5 million fine imposed on Resorts World Las Vegas underscores the severe consequences of neglecting anti-money laundering (AML) compliance within the casino industry. The Resorts World Las Vegas money laundering scandal serves as a cautionary tale, highlighting the critical need for robust internal controls, comprehensive staff training, and proactive measures to prevent financial crime. The implications extend beyond a single casino, impacting the entire industry and potentially leading to stricter regulations and heightened scrutiny. Staying informed about developments in casino regulations and the ongoing fight against money laundering is crucial. Stay updated on the latest developments in Resorts World Las Vegas and similar cases by following [link to relevant news source or regulatory body].

Featured Posts

-

Viniloviy Bum Teylor Svift Ustanovila Noviy Rekord Prodazh

May 18, 2025

Viniloviy Bum Teylor Svift Ustanovila Noviy Rekord Prodazh

May 18, 2025 -

Riley Greenes Historic Night Two 9th Inning Home Runs

May 18, 2025

Riley Greenes Historic Night Two 9th Inning Home Runs

May 18, 2025 -

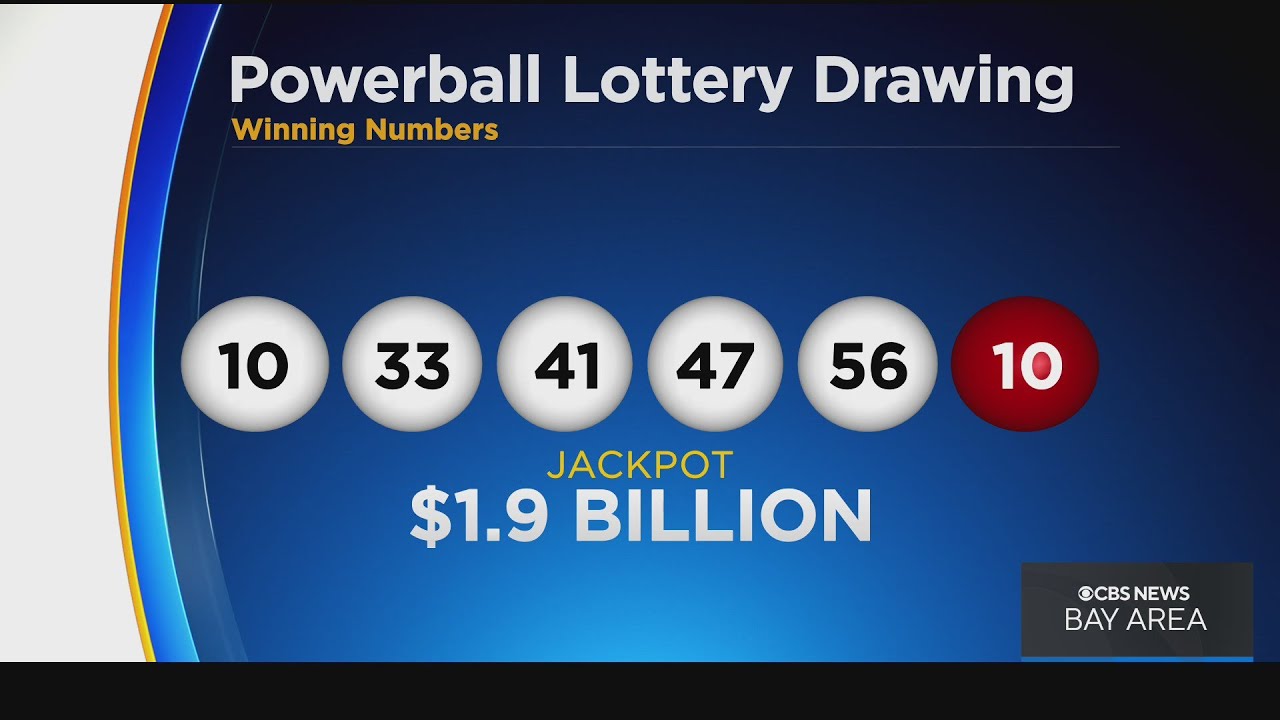

Daily Lotto Winning Numbers For Friday 25th April 2025

May 18, 2025

Daily Lotto Winning Numbers For Friday 25th April 2025

May 18, 2025 -

2025 Spring Breakout Rosters A Scouting Report

May 18, 2025

2025 Spring Breakout Rosters A Scouting Report

May 18, 2025 -

Your Guide To The Top Bitcoin And Cryptocurrency Casinos In 2025

May 18, 2025

Your Guide To The Top Bitcoin And Cryptocurrency Casinos In 2025

May 18, 2025

Latest Posts

-

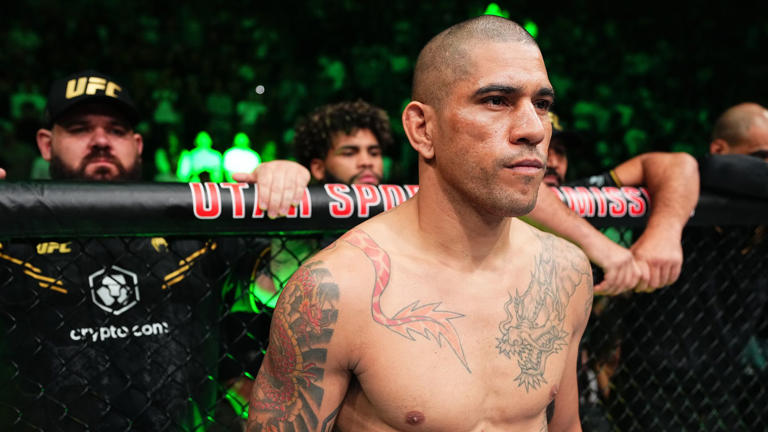

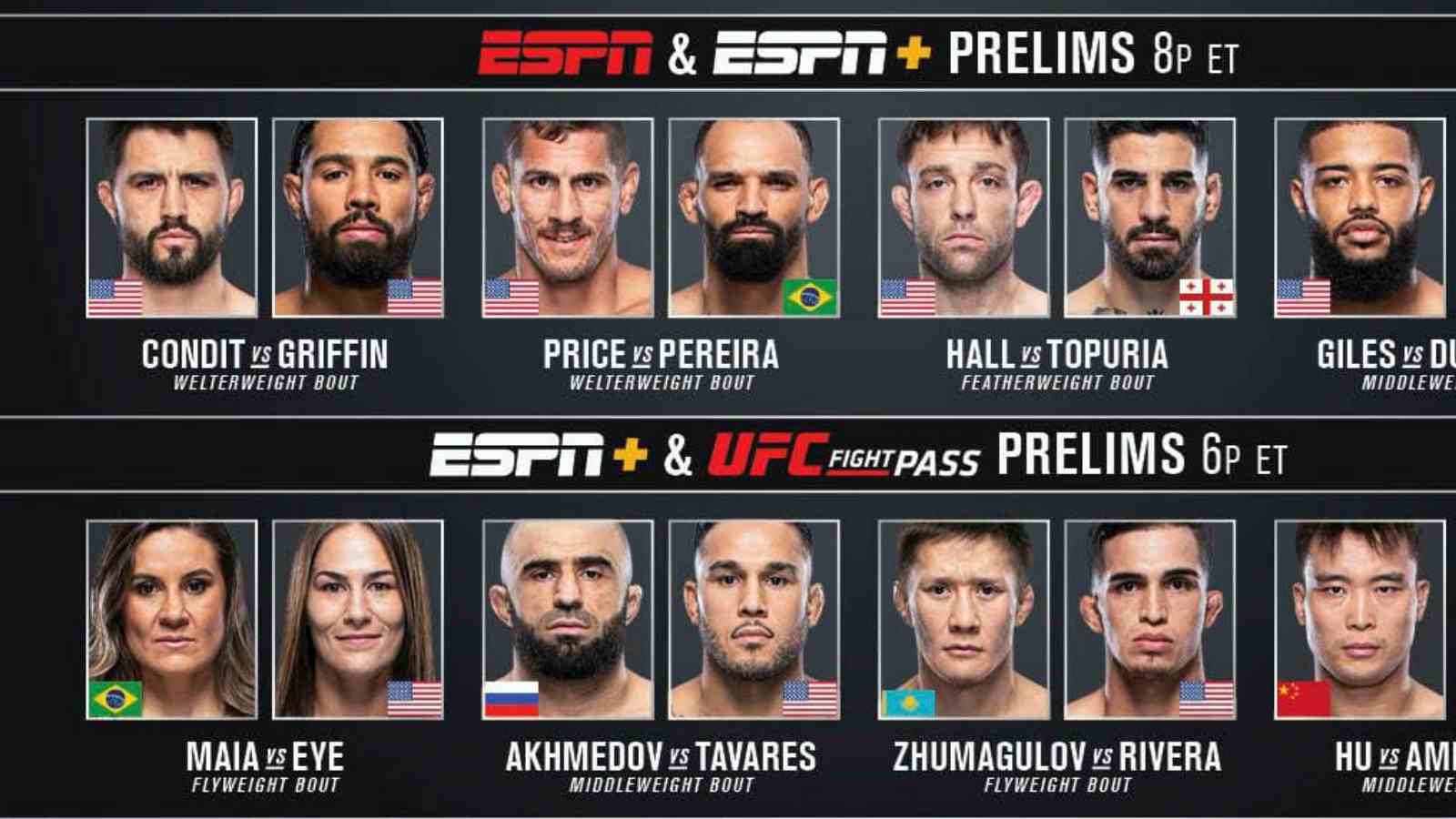

Ufc 313 Controversy Fighter Admits Loss Was A Robbery

May 19, 2025

Ufc 313 Controversy Fighter Admits Loss Was A Robbery

May 19, 2025 -

Ufc 313 Star Concedes Opponent Deserved Victory Amidst Robbery Claims

May 19, 2025

Ufc 313 Star Concedes Opponent Deserved Victory Amidst Robbery Claims

May 19, 2025 -

Post Ufc 313 Fighter Reflects On Questionable Prelims Victory

May 19, 2025

Post Ufc 313 Fighter Reflects On Questionable Prelims Victory

May 19, 2025 -

Fighters Honest Admission Ufc 313 Prelims Fight Controversy

May 19, 2025

Fighters Honest Admission Ufc 313 Prelims Fight Controversy

May 19, 2025 -

Ufc 313 Prelims Fighter Concedes Unfair Victory

May 19, 2025

Ufc 313 Prelims Fighter Concedes Unfair Victory

May 19, 2025