1,050% Price Hike: AT&T On Broadcom's Proposed VMware Cost Increase

Table of Contents

The Proposed VMware Acquisition and its Impact

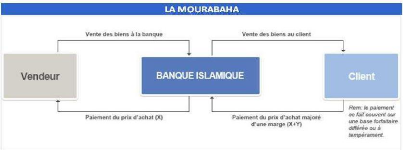

Broadcom's acquisition of VMware, a leading provider of virtualization and cloud computing solutions, has sent ripples throughout the tech world. This multi-billion dollar deal signifies Broadcom's aggressive expansion into the enterprise software sector, a move with significant strategic implications. Broadcom, known for its history of acquisitions and often subsequent price increases, aims to leverage VMware's extensive customer base and market dominance.

This aggressive acquisition strategy, however, raises serious antitrust concerns. Regulators are scrutinizing the deal closely, concerned about the potential for reduced competition and monopolistic practices leading to inflated prices for VMware products.

- Potential benefits for Broadcom: Increased market share, expanded product portfolio, access to a vast customer base.

- Potential drawbacks for VMware customers: Significantly increased costs, potentially reduced innovation due to a focus on profitability over product development, vendor lock-in.

- Regulatory scrutiny and potential challenges to the acquisition: Antitrust investigations and potential legal challenges could delay or even prevent the acquisition from closing.

AT&T's Perspective: A 1,050% Price Hike

AT&T's public statements regarding the proposed price increase paint a stark picture. While specific quotes might not be publicly available at this time, reports indicate a potential increase exceeding 1050% for certain VMware products and services. This represents a massive financial burden for AT&T, impacting its budget significantly and forcing it to re-evaluate its IT strategy.

AT&T's response is likely to involve a multi-pronged approach. Negotiations with Broadcom are likely, along with exploration of alternative virtualization solutions and potentially a reduction in its reliance on VMware products.

- Specific VMware products facing price hikes: This could include vSphere, vSAN, NSX, and other core virtualization and networking components.

- Estimated financial impact on AT&T's budget: The exact figure is dependent on AT&T's current VMware licensing agreements but represents a significant budgetary strain.

- Potential alternatives for AT&T to consider: This could involve migrating to open-source solutions, adopting competing virtualization platforms, or exploring cloud-based alternatives.

Industry-Wide Implications of the VMware Cost Increase

The impact extends far beyond AT&T. The proposed VMware cost increase threatens businesses across various sectors relying on VMware solutions for critical infrastructure. From healthcare and finance to education and manufacturing, the potential for widespread cost increases is significant. This could trigger a domino effect, pushing up prices across the entire software sector.

The situation also presents an opportunity. The acquisition could spur increased competition in the virtualization market. Existing competitors might see this as a chance to gain market share by offering more competitive pricing and innovative features.

- Industries most affected by the price increase: Any industry heavily reliant on VMware for its IT infrastructure will experience significant financial impacts.

- Potential for alternative virtualization solutions to gain market share: Companies like Nutanix, Citrix, and open-source alternatives could experience a surge in demand.

- Long-term implications for the enterprise software landscape: This acquisition could reshape the competitive dynamics within the enterprise software market, possibly leading to greater consolidation or a more fragmented landscape.

Regulatory and Legal Responses to the Proposed Price Hike

Given the potential for anti-competitive behavior, regulatory bodies worldwide are closely examining Broadcom's acquisition of VMware and the associated price increases. Antitrust investigations are likely, and legal challenges could arise from various stakeholders, including competitors and affected customers. Government intervention, potentially including price caps or other regulatory measures, could be considered to mitigate the impact on businesses and consumers.

- Regulatory bodies involved in the review process: Agencies like the FTC in the US and the EU Commission will play crucial roles in the review process.

- Potential legal challenges to the acquisition: Lawsuits challenging the acquisition on antitrust grounds are a distinct possibility.

- Possible outcomes of regulatory investigations: Outcomes could range from acceptance of the acquisition with conditions to a complete block of the deal.

Conclusion: Navigating the VMware Cost Increase – A Call to Action

The proposed 1050% VMware cost increase, driven by Broadcom's acquisition of VMware, poses a serious challenge for AT&T and the wider technology industry. The potential consequences are far-reaching, impacting budgets, IT strategies, and potentially the competitive landscape of the entire virtualization market. Businesses must proactively plan for this significant price fluctuation, exploring alternative solutions and preparing for potential regulatory interventions. Stay informed about the ongoing developments surrounding the Broadcom-VMware deal and its impact on VMware licensing costs. Proactive planning and exploration of alternative virtualization solutions are crucial to mitigating the effects of this substantial VMware cost increase. Share this article and join the conversation—let's navigate this challenge together.

Featured Posts

-

Data Breach Executive Office365 Accounts Targeted In Multi Million Dollar Heist

Apr 23, 2025

Data Breach Executive Office365 Accounts Targeted In Multi Million Dollar Heist

Apr 23, 2025 -

Action Solutions 30 Pourquoi Un Avis Haussier Previsions De Cours

Apr 23, 2025

Action Solutions 30 Pourquoi Un Avis Haussier Previsions De Cours

Apr 23, 2025 -

Nutriscore Au Petit Dejeuner L Analyse Des Produits Morning Retail

Apr 23, 2025

Nutriscore Au Petit Dejeuner L Analyse Des Produits Morning Retail

Apr 23, 2025 -

Trump Administration Tariff Talks With Walmart And Target Executives

Apr 23, 2025

Trump Administration Tariff Talks With Walmart And Target Executives

Apr 23, 2025 -

Post La Fire Housing Crisis Landlords Accused Of Exploitative Rent Increases

Apr 23, 2025

Post La Fire Housing Crisis Landlords Accused Of Exploitative Rent Increases

Apr 23, 2025